주목해서 볼 부분

위 영상을 보고 EQT의 컨콜을 읽어보기로 결정. 무슨 이야기가 나오는가 확인.

특히 다음과 같은 항목들에 주목.

- AI 데이터센터 발 전력수요 증가가 실제 EQT의 사업에 미치는 영향이 있는지 여부

- 이를 대비한 CAPEX 증가 계획이 있는가?

- 아니면 데이터 센터 관련 실제 실적에 숫자로 찍힌 부분이 있는가?

- 가이던스에 해당 부분이 반영 됐는가?

요약

다 읽었는데, 너무 길다….

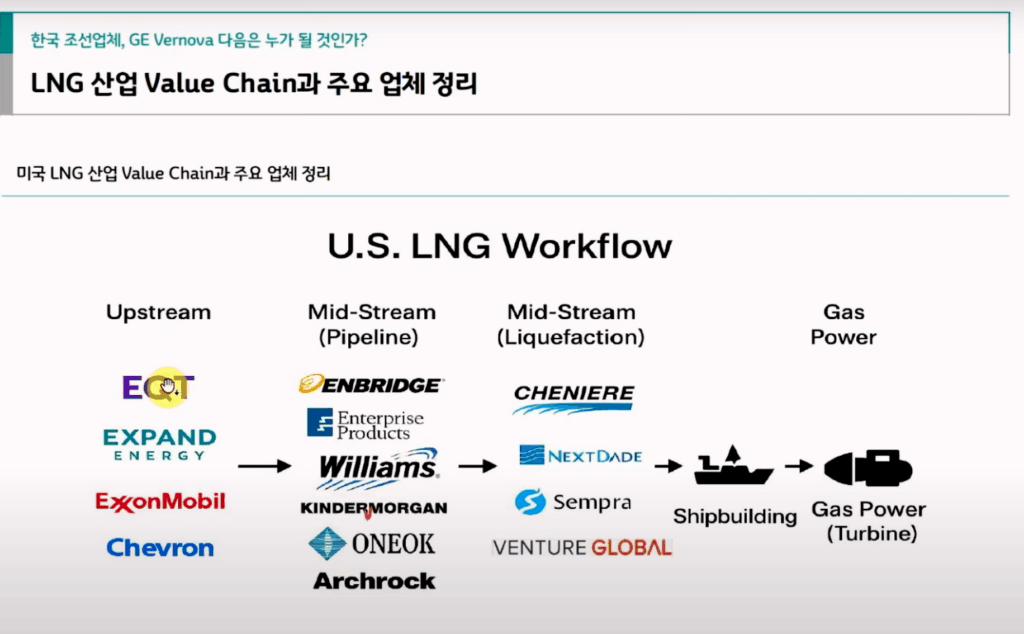

요약하면, 이미 데이터센터로부터 계약이 연달아서 나오고 있는 상황. 단, 왜 주가는 지지부진한가에 대해서 생각해보면, Appalachia와 Permian에서는 천연 가스 생산 기업들이 증산하지 않고 수익성 있게 운영하고 있는 반면, Haynesville의 경우 무분별한 증산으로 수익을 내지 못하고 있는 상황.

따라서 시장의 우려는, 천연가스의 생산량 증가가 매우 커서, 데이터 센터의 수요를 충당하고도 남을 것을 우려하고 있는 것으로 보임.

그러나 컨콜을 자세히 읽어보면 그러한 우려는 과도한 것으로 판단. 예를 들어 데이터센터 향 수요 증가로 천연가스가 생산되는 지역의 가스 수요가 급증할 것으로 예상하며, EQT는 최종 수요자와 당장 가격이 더 비싼 hub price가 아닌, 가격이 낮은 local price로 계약하는 모습을 보임.

다만, 이런 계약이 실제 실적이나 가이던스에 적극 반영되지 않으며 주가는 저평가 상태를 유지하는 것 같음. 예를 들어 다음과 같은 경영진의 발언이 상당히 주목할만함.

Devin McDermott

And here, we have multiple strategic growth projects already executed by the middle of the year across both upstream and midstream. I was wondering if you could just talk a little bit about the opportunity set as it sits today. Have you executed on your targets at this point? Is there still more room to run? How are you thinking about the longer-term evolution of strategic growth and the opportunity set for in-basin demand?

Toby Rice

Either we’ve significantly underestimated the size of this opportunity or we are over executing on our ability to capture these opportunities.

우리의 생각보다 더 많은 계약이 나오고 있다는 이야기로써, 다음(3Q)이나 다음, 다음 분기(4Q) 실적발표에서 내년 가이던스 상향과 같은 좋은 소식이 주가 상승의 신호탄이 될 수도 있겠다는 인상을 받았다.

따라서 계속해서 EQT의 주가와 뉴스를 모니터링하고, 전방 산업에 속한 기업인 GEV 등을 모니터링 하는게 중요하다고 판단된다.

하이라이트

Prepared Remarks

Production was at the high end of guidance, benefiting from robust well productivity and outperformance from compression projects.

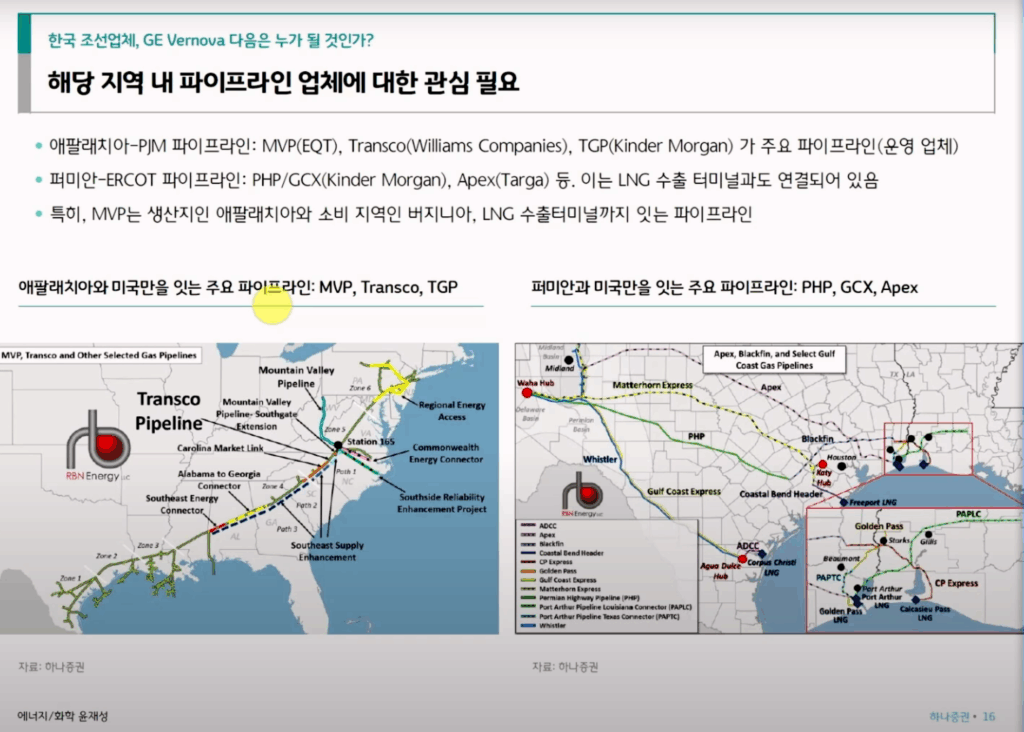

First, we are concluding the open season of our MVP Boost project, which is set to add 180,000 horsepower of compression to the MVP mainline and increased capacity from 2 to 2.5 Bcf per day. This project will provide additional takeaway from Appalachia into Virginia to serve the Southeast markets, unleashing reliable, low-cost, low emissions natural gas into a region that is seeing significant demand growth.(데이터센터 밀집 지역)

As a result of strong project momentum, we have elected to jump start long lead time orders this year in order to derisk the MVP Boost construction time line. MVP Southgate will provide 550 million cubic feet per day of capacity from MVP mainline into the Carolinas, serving anchor customers, Duke Energy and the Public Service Company of North Carolina.

Additionally, we are working to finalize our 20-year definitive agreement with the Frontier Group of companies to provide, long-term natural gas supply for the Shippingport Industrial Park project Northwest of Pittsburgh. The project will convert a retired coal power plant into a large-scale 3.6 gigawatt natural gas power generation facility with peak natural gas consumption of approximately 800 million cubic feet per day. The project has secured a partner to build a co-located data center facility to support AI infrastructure and contemplates several phases of development beginning in 2027 and ramping through 2028, providing significant upstream growth optionality for EQT to meet increasing demand.(EQT가 이 프로젝트의 주요 천연가스 공급사로 참여)

We are also working to finalize our 20-year definitive agreement with Homer City redevelopment to build midstream pipeline infrastructure and be the project’s exclusive supplier of natural gas. (EQT가 이 프로젝트의 주요 천연가스 공급사로 참여)

Additionally, we signed an agreement to build midstream infrastructure serving a new 610-megawatt combined cycle natural gas power plant in West Virginia, with gas demand of approximately 100 million cubic feet per day that will serve the PJM market. This project is poised to be the state’s first large-scale gas-fired power plant and is being developed by a global investment-grade power company in partnership with a marquee private equity sponsor.

Collectively, these projects represent a pipeline of nearly $1 billion of organic investment opportunity with premium, low-risk supply agreements which we estimate will generate an aggregate free cash flow yield of approximately 25% once fully online.

(이 예측은 LNG 장기 계약을 기준으로 산출. 즉, LNG 가격이 크게 올라도 EQT의 수익성이 크게 늘어나지는 않는 구조. 단, 신규 프로젝트에서 더 높은 가격으로 진행하며 기업 가치가 늘어날 가능성은 있음.)

The shipping port and Homer City facilities, the West Virginia power plant, the increase in MVP utilization plus the MVP Boost expansion represent new Appalachian gas demand of nearly 3 Bcf per day. This demand will be served in large part by EQT volumes flowing predominantly through EQT infrastructure, underscoring the differentiated growth opportunity for EQT.

Turning to our recently announced pipeline of growth projects. We expect these projects to create a collective growth CapEx opportunity of approximately $1 billion over the next several years, and we expect to begin spending capital on associated infrastructure in 2026 with investments spaced out over a multiyear period. We structured the 2 data center projects as Index-plus style deals on fixed volume commitments.

While we cannot disclose specific contract terms or end customers, before the impact of upstream volume growth or basis tightening, we expect these projects to add approximately $250 million of recurring free cash flow by 2029. Initially, we will reallocate volumes to fill this new demand, followed by steady, mid-single-digit multiyear growth. We have the capacity to grow production by at least 2 Bcf per day to backfill these volumes, which means we’ve set the stage to responsibly grow the business by at least 30% over the coming years.

Turning to natural gas macro, while there are near-term headwinds primarily due to production growth, we continue to hold a structurally bullish view for prices as we look out to 2026 and 2027. First, on the supply side, there is growing evidence that associated gas growth is slowing. The oil-directed rig count has declined by approximately 50 rigs or roughly 11% since April. While Brent and WTI pricing has rebounded off their April and May lows, we believe global oil markets still lean towards oversupply, particularly given OPEC’s strategy to rapidly add back barrels and defend market share.

That backdrop suggests U.S. oil activity will remain subdued into next year as operators stay disciplined and focused on shareholder returns. Critically, this curbs a major source of incremental gas supply. At the same time, the demand picture continues to strengthen as we expect a meaningful step-up in LNG exports by Q4 with Plaquemines LNG reaching full rate and Golden Pass LNG beginning operation.

This increase is on top of the 2.5 Bcf per day of LNG demand growth we’ve seen since the beginning of 2025 and should quickly tighten balances, especially as U.S. dry gas supply struggles to keep pace.

All told, production is up, operating costs are down, and capital efficiency continues to improve.

Q&A

Douglas George Blyth Leggate

what’s the CapEx cadence to get to that $250 million of free cash flow growth by 2029.

Toby Rice

When we’re talking about the $1 billion of CapEx on the — really related to the midstream side of things, that’s going to be back weighted closer towards ’28. So we’ll see a little bit of that show up in ’26, but then it will start showing up closer to ’27, ’28.

Jeremy Knop

when we look at our forecast, it kind of where strip is in the high 3s, I mean we’re generating north of $3 billion a year. And so you get to a level where our net debt can be approaching 0 and there’s still a lot of dollars left over. So I think we have opportunity both ways and a ton of flexibility no matter how the macro plays out.(2027, 2028쯤엔 부채가 거의 0일 것이므로 capex 증가로 인한 재무 상태 악화에 대해선 염려하지 않아도 된다는 이야기)

Douglas George Blyth Leggate

But what would it take for you to actually grow production? I’ll leave it there.

Toby Rice

Just to highlight this growth opportunity and what this means in an end-state scenario, let’s just use a Bcf a day of growth. That will translate to, call it, 360 Bcf of increased production. End state, looking at our cost structure, about $2, take a $4 Henry Hub price, you’re talking about $720 million of free cash flow, throw an 8% yield on top of that, free cash flow yield, that’s $9 billion of value, about $15 a share.(하루 생산을 1 Bcf 늘리면 주가가 25% 오를 만한 가치가 창출된다는 계산)

Devin McDermott

I was wondering if you could talk a little bit more about the evolution of capital on that side over the next few years.

Jeremy Knop

I think as we move into 2026 and 2027, you’re going to see the maintenance piece of our spend come down, but you will see the growth piece of it go up.

Devin McDermott

And here, we have multiple strategic growth projects already executed by the middle of the year across both upstream and midstream. I was wondering if you could just talk a little bit about the opportunity set as it sits today. Have you executed on your targets at this point? Is there still more room to run? How are you thinking about the longer-term evolution of strategic growth and the opportunity set for in-basin demand?

Toby Rice

Either we’ve significantly underestimated the size of this opportunity or we are over executing on our ability to capture these opportunities.

Arun Jayaram

I was wondering if you had thoughts on the time line to reach the full 800 Ms on the Shippingport facility and 665 in Homer City. What do you expect is the time line to reach those volume commitments?

Jeremy Knop

I think for both of them, we think about it as year-end 2028.

Arun Jayaram

Great. And my follow-up. How do you see yesterday’s PJM auction clear at the price cap? How do you see this impacting gas power gen development and gas demand overall, given indications of continued power market tightening?

Jeremy Knop

But look, there’s power that’s needed and the power is going to get built and you’re seeing generation willing to be built, but at a higher price, and that’s what’s happening through those auctions.

Neil Mehta

And just would love your perspective on how you’re pricing it? And just would love your perspective on how you’re pricing it? It sounds like you’re tying it to M2 plus. And so implicit in that is a view that the differentials should be tightening up over time. So can you just talk about how much flexibility was there to price it to hub versus pricing it locally. If there was that flexibility, why did you choose local pricing?(데이터 센터에 가스 공급 계약에서 왜 가격이 더 저렴한 local pricing으로 계약했나?)

Jeremy Knop

Jeremy Knop

Yes. Great question. So we’re trying to obviously get the most value out of this we can, but also provide an anchor liquid pricing point for customers so they can financially hedge if they want to take some of the volatility out. Like I said in the prior comments, we are very bullish Appalachian pricing actually relative to Henry Hub. I know it’s not the consensus view right now. But when you see all this demand show up in the face of probably half of the players in Appalachia running real thin on inventory come into the decade, it does set up for a really interesting sort of paradigm shift where I think that basis tightens a lot. So we intentionally are structuring them linked to that for multiple reasons. I think it’s best for the customer. I actually think it’s best for EQT at the same time.(Apalaccia 지역의 데이터센터 증가로 로컬의 가스 가격이 더 비싸질 것으로 예상하고 계약함.)

Neil Mehta

That’s helpful, Jeremy. And then the follow-up is just on the near-term macro. Maybe just as we’ve been surprised by some of the scripts that have come in with production at 107 is probably north of it’d be higher than what we would have anticipated in the near term. Have you guys been surprised by that? Has that affected the way you think about how we exit October and set up for the winter? And just in general, as you think about near-term producer discipline, are we seeing some breakdown?

Jeremy Knop

I think the short answer is yes. I think we — I think our view of Appalachia specifically is from this point towards the end of the year, you’re flat to down. It looks like from what the data we see the Permian is also relatively in check. You’re not seeing any sort of like race to add production growth. It’s really the Haynesville and it’s other basins. And again, it’s more of what we’ve seen in the past. It’s producers chasing price signals.

And look, this morning, you’re seeing gas approaching $3, right? I just — I think if we add Haynesville assets, we would be really hard pressed as to why there’s justification to add activity right now. I think there was a view for the past 2 years that 2025 was going to be this year that a lot of these producers could exit and sell their businesses. And lo and behold, they do the same thing again. They push pricing down to a level where if you’re in the Haynesville, you’re not getting your money back, where well productivity is today at current well costs.

And so again, it’s just another example of the value destruction that comes out of unsustainably chasing prices. And again, as we talk about what does it take for EQT to grow, it’s lining up our supply with known demand through our infrastructure through contracts. It’s a very different, much more disciplined way that we look at it. But again, it’s — if we see this continued surge of production, there’s certainly downside pricing in the years ahead. We certainly hope that didn’t happen. It’s not something we control.(이것이 EQT 투자의 가장 큰 리스크!!! 가스 가격 상승에 따른 경쟁적인 증산.)

But the good thing about being the lowest cost producer and the position EQT is in today is we make a bunch of money either way. Even at $3 gas, we can make a bunch of money. And if gas goes up, we’ll make a bunch of money, too, because we can be unhedged. So it fits perfectly into how we’ve sculpted the business. But again, short answer is we do think production is too high. We’ve been surprised to the upside, and I certainly hope it doesn’t continue surging.

Joshua Silverstein

I just had a question on the 2 Bcf a day potential growth here. How do you set yourself up to deliver mid-single-digit growth? Is there enough infrastructure in place already to support this or the new projects then capable of delivering that? And then do you build up any sort of backlog over the next few years to then have that as the storage to be able to deliver that when the demand is there.

Toby Rice

Yes, Josh. So when we’re looking at supplying these specific demand opportunities, we will be building out new midstream infrastructure, connect them to existing gas networks. A lot of those will be connected that EQT has our volumes connected there. So our commercial footprint is going to allow us to move gas around. We’ll be going through optimization exercise on what exactly is the best way for us to fill the supply to get to these new interconnects. But this is one of the reasons why people are selecting this region to build their data centers is because they’re building on top of a lot of gas infrastructure and EQT will close that last mile and then be in a position to optimize.

Joshua Silverstein

Got it. And then obviously, there’s a lot of focus on the power side, but I wanted to see if you can now give us an updated view on the LNG contracting plans. Based on current supply levels, it’s about 20-plus of your current supply. Do you want to have 10% or so to the LNG market? The LNG markets now look less attractive to you because of what you’ve been signing in the power market. So any update there would be great.

Jeremy Knop

Yes. Thanks for the question. I think — so our long-term goal in the LNG markets is actually to do very similarly what we are doing on the power and data center side right now, which is link up supply directly to an end user of that gas. That’s why we’re trying to contract the way we are. Long term, we still want to have 5% to 10% at least of volume. I think as our credit ratings continue to rise, I think our appetite for leaning into more of that will also rise. I think that’s more of a 2030 and beyond opportunity where that LNG market is going to really be tight and we can make a lot of money there.

We’re actually in discussions with a number of facilities right now. Those discussions have actually improved and ticked up recently. So we’re actually really excited about that opportunity. And I think what we’re proving we can do domestically with our platform is, in essence, exactly what we plan to do internationally. We’ve been having conversations with some international customers that have really underscored, I think, how great that opportunity is.

But again, we just want to do it the right way. Those long-term contracts can be very costly if not structured the right way. But I think beyond what we do domestically, that is a huge opportunity for us. And for any company who has a platform like we do, that’s built to do deals like this directly within customers.

Q – Wei Jiang

I would love to dive into the M2 dynamic a bit more since you guys are really doubling down on a bullish view there. Basically, how big is the M2 and local market in that region? If based on what you guys are saying, it’s 1.5 Bcf per day of demand that we could see from the power deals. [ MVPX ] and then the Transco expansion that could add another 1 Bcf per day. Like how material is that demand versus the market size? How easily is it for other producers to deliver volume to that market? So really just trying to get a better sense on the bull case scenario on where that M2 price could go.

A – Jeremy Knop

Yes, it’s a great question. It obviously depends seasonally, but I say if you look at the 2 of the biggest markets being that M2 market along TETCO and then the Dominion market called EGTS now, we typically look at those as being 5 to 7 Bcf a day each, again, depending on the season. I think each of these opportunities as they emerge are going to create very large demand sinks and very specific points. And so how we go through the process of marketing gas volumes and supplying those, whether it’s EQT volume, buying other third-party volume or reallocating depending on where we are in that growth ramp, it’s going to evolve. We’re working through the most efficient plan to do that right now.

So I think there’s some element of basis tightening, but that is really taking volume, for example, that we might sell from Olympus into EGTS, take it 20 miles down EGTS and pull it into Homer City as an example, so it really is supply matching. If you look at other projects like Mountain Valley, that plant — or sorry, that pipeline is served on the tailgate of the Mobley plant, and we deliver a lot of gas there through Hammerhead and OVCX and other pipelines. That is predominantly all EQT gas. So I think for anyone who is buying gas in MVP, you’re still buying EQT gas and interfacing with EQT at Mobley.

So I think there’s a tremendous amount of upstream opportunity. But to the point Toby made in his opening remarks, this is predominantly EQT infrastructure, whether it’s existing or new build and in a core EQT operating area, meaning it’s EQT volume. So I think there’s a broader view that it’s — yes, it’s an opportunity for everybody in Appalachia. I think the way we see the volume is actually flowing, is it’s really more of an EQT opportunity, which is why we’re talking about filling it with growth and reallocating. We have a little over 2 Bcf a day today that we can reallocate.

So in theory, we don’t have to grow at all if we don’t want to. But I think in the long term, the most value-accretive thing for shareholders is us to tailor in moderate responsible growth to backfill as we reallocate that. So I think there’s tailwinds on both sides, but it’s not going to be evenly distributed across producers from the way we see volumes flowing.

Wei Jiang

That’s really interesting color. So along that line, when you think about your pricing signal, are you looking at M2 specifically that you need to see maybe M2 getting to narrow its discount to, I don’t know, $0.50 or something better than where it’s now for you to see that production like backfilling that volume response?

Jeremy Knop

I think it’s a combination of both Hub and M2 and EGTS. Look, if you had a weak period in Henry Hub, but also tighter basis, we might still say the cheaper thing to do is just reallocate volumes as opposed to growing to it. We could build DUCs if we wanted to just to prepare for a period where pricing been rebounded. But again, the beauty of our scale and infrastructure platform is we can be flexible. So answer is it kind of depends. It’s hard for us to concretely commit to anything this early out because this is something that’s really 3 to 5 years from now. But the point is that we continue making is we have a ton of flexibility.

Operator

And your next question comes from the line of Phillip Jungwirth with BMO Capital Markets.

Phillip Jungwirth

On the West Virginia Power project where you’re providing midstream infrastructure. Is there any reason to think you wouldn’t also be supplying volumes? And if this is still to come, how much does midstream give you a competitive advantage here?

Jeremy Knop

I’d say that is our expectation. It’s not fully committed yet. That project should reach FID in the back half of this year, operating near full utilization, that’s around 100 million a day of gas supply. So it’s not this sort of mega level of the other 2 projects. But I think logically, it is a project we will also supply gas to. But I think more to come on that project.

Toby Rice

Yes. As far as the competitive edge with midstream, midstream is a competitive edge. I mean being integrated allows us not only to give them access to supply, but connect the dots for them. So I think it’s been incredibly helpful as we’ve sourced these opportunities.

Jeremy Knop

Yes. I would say, too, the one thing that Toby and I found to be really interesting is when we and our teams look at these opportunities, we start first with what is the best solution for the customer and how do we connect those dots to provide the most efficient solution. If you don’t have all the tools in the toolbox between midstream and gas trading and the quantity of supply and investment-grade ratings, you just — you simply can’t offer that. You have one product to offer.

So I think for a project like this power plant, we can truly come to them and say, we have the best solution or we can create the best solution for you if it’s not a market solution. And I think that’s one of the reasons why we’ve been able to be really successful. And really, so far, the partner of choice for these big projects as they’ve been developed.

Phillip Jungwirth

Okay. Great. And then on MVP Boost, the open season here, I’m not sure how much you want to get into it, but are there any initial expectations as far as interest from demand pull type customers versus producers? And more broadly, just a similar question as it relates to some of these third-party proposed pipelines out of Appalachia. Tariffs look like they could be quite high for producers. So how do you — how likely do you view some of these projects ultimately reaching FID?

Jeremy Knop

I’d say we got to be careful on what we say because that open season is still active right now. I think our expectation is that in certain markets where there’s a lot of scarcity for gas right now, the need for volumes or that egress sits more with the end users as opposed to the producers. Consistent with, I think, some of our comments in the past, I think these pipes, if and when they get built, will predominantly be underwritten by demand-pull shippers as opposed to supply-push producer shippers like you saw over the past decade. But look, we’ll see when the open season concludes and we can provide more color next quarter.

Scott Hanold

Got it. Okay. And then my other question becomes — or it goes to the deep Utica opportunity. Obviously, you’ve talked about that underlying the — some of the Olympus assets and probably elsewhere in your asset base. When does that become a target that you look a little bit harder at? Do you see that as more of a longer-term option? Or is that something you’re willing to test a little bit more near term to help support the growth opportunity you need on your production base?

Toby Rice

Yes, it’s a longer-term opportunity for us. That said, we could do some science work and give the team some opportunities to prove themselves on the cost side. Utica, I think we feel pretty good about the resource. It really is going to be more about the operational execution. So I mean we could call it science because we don’t technically have that labeled as noncore. But it could be a tool for us to feather in. I mean all of this, I think, would really want to have a better appreciation for the upside inventory if we continue to see momentum on the commercial front supplying these power plants, just having more confidence on inventory, I think, could be helpful. It may be a reason why we go out there and do a couple. But it’s more of a longer-term in nature.

Jeremy Knop

Yes. It’s kind of interesting. Good point on this, and I know the Deep Utica has got more airtime. In Southwest Appalachia, when most producers talk about inventory depth, we all just refer to the Lower Marcellus, which is really the main Marcellus member. If you look at the Northeast part of the play, inventory numbers referenced now include a heavy disproportionate amount of Upper Marcellus, which is call it, 1.5 Bcf per 1,000.

And you look at the Haynesville, most of those numbers referenced now include a disproportionate amount of Middle Bossier. And when you think about the productivity of those second degree or sort of like second-tier members of the formation to develop, compare that to the Deep Utica where around the Olympus area, the way we underwrote that is, call it, like 2.5, 2.6 Bcf per thousand and with well costs that are probably around what Haynesville well costs are, but that’s before anybody has really spent time trying to drive the cost down.

So for us, it’s a free option, and I think takes our 30-ish years of inventory out much further. And so when we think about what could we grow into, there’s a ton more resource out there that we have rights to in Appalachia that keep that opportunity wide open for us to continue growing. Just a question of what price and how efficient can we get on the operations side drilling the wells.

Operator

And your next question comes from the line of Roger Read with Wells Fargo.

Roger Read

Maybe just come up with a couple of things here. One, sort of been talked about it, I guess, as we’ve gone through the call here, but the idea with the very high PJM prices that are out there. Obviously, local need, you’ve got the infrastructure. What are you seeing? Or is there any way for you to kind of give us an idea of what’s happening in the, call it, the behind the meter, the off grid in terms of demand beyond the very high-profile Homer City and Shippingport type projects?

Toby Rice

Yes. I’d say the dynamic that we’re seeing is that in order to get this infrastructure built, people are going to be having to sign up for PPAs that are just higher than what market pricing is right now. I think that has been something that’s caused a little bit of people just pause to make sure that what they’re signing up for is needed. But it’s — I think people now realizing the only way to get this infrastructure built is to get these PPAs in place, and it’s — and with inflation that’s taking place, it’s going to require a little bit higher pricing than what people have been accustomed to. But it’s encouraging to see that these projects are going to be going forward.(장기 계약을 위해 데이터센터 등 전력 수요층이 PJM price 보다 높은 가격으로 계약을 할 수 밖에 없다는 이야기.)

Jeremy Knop

Yes. I think there’s also the opportunity to add some peaking supply capacity. And when you add that allows you to increase your capacity factor across existing baseload from the levels that you see today and still have that reliability. But that additional peaking supply at current inflated rates due to the scarcity of equipment simply requires a much higher price than it did even before. And I think that’s one of the misconceptions that we’ve observed is you’re seeing much higher electricity prices, but you’ve also seen the cost of building these gas plants roughly double from what they might have been 3, 4 years ago. So logically, just to keep economics flat, you need your spark spreads probably double, too.

So again, I think when you read through the economics of what it actually takes to build one of these plants, you can — the need for electricity prices to rise and allow the market to evolve to meet the needs today and over the coming years, just simply requires higher prices and less the price of building these projects and the cost of capital falls back lower again.

Roger Read

Okay. And then just an unrelated follow-up. How are you thinking about hedging strategy at this point? I know at different times, there’s been a goal for debt and then stepping away from hedging other times tied to what’s going on maybe with the midstream business. You’ve laid out potential — not potential, but likely future CapEx increases on the midstream side, so not really price sensitive on the backside, but maybe price-sensitive upfront on the CapEx commitment. So does that affect any way you’re thinking about hedging over the next year or two?

Jeremy Knop

Let me put it this way. So when we think about the appropriate debt level for our business, I mean, I made this comment in our opening remarks, at $2.75 gas, like Henry Hub pricing, unhedged, we generate in a given year between $1 billion to $2 billion of unlevered free cash flow. Or said another way, like your EBITDA less maintenance CapEx. So at $5 billion, you’re looking at a little over 3 years of just steady state unhedged to repay all your debt, right? That compares to a lot of our peers that are free cash flow negative at that point in time.

So yes, we are trying to get our ratings higher. The agencies still want to see our debt at a low level. But fundamentally, I already feel like we’re very under-levered and our balance sheet is in a very safe spot. We’re mostly focused on our maturities right now, specifically looking out to 2027 and resculpting that.

So look, hedging is something that I think we are less and less focused on. And I think if we’re in a structurally bull market over the next 5 to 10 years, programmatically hedging or really hedging any other way aside from being opportunistic will net result in value destruction over that period of time relative to just being a taker of where prices settle. And at the same time, it gives us more flexibility in how we nominate our volumes, whether it’s first to month or in the spot market.

So I think as we move to a position where really no matter what prices are, we’re going to be rapidly repaying debt, able to fund projects confidently and wanting to provide investors that exposure to gas prices they want by investing in EQT structurally in addition to the growth we’ve talked about today. I think our bias continues to be lowly hedged if not hedged at all. And if we are going to hedge, do the types of things that we’ve been doing recently hedging 4 x 7 cost plus, right? I think we’d be happy hedging a lot of that sort of price. And if we lose above $7, that’s probably a fine outcome for our business.

Toby Rice

Yes. And only other dynamic I’d just add here is these investments that we’re making in our sustainable growth projects are going to bring durability to our cash flows. And this $250 million of midstream free cash flow from these growth projects, I mean, those are going to bring a pretty decent amount of durability. So we also are thinking about ways that our growth is going to continue to solidify the cash flow story at EQT, which is just worth noting. It’s like adding a hedge.

Jeremy Knop

Yes. I mean, $250 million to Toby’s point is another $0.10 reduction in our breakeven cost by the time all this comes online towards the end of the decade, it’s a huge savings. And it takes us, I think, in our view, as you model that out below $2.

Operator

And your next question comes from the line of Jacob Roberts with TPH.

Jacob Roberts

Hopefully, a quick one. In a pure reallocation scenario, and I know it will be pricing dependent. But do you see a meaningful shift to the percentages you guys lay out on Slide 24?

Jeremy Knop

I think that it’s just simply going to be our election. And again, I think that goes back to Betty’s question earlier about where pricing is on a relative basis. If we see basis price tighten up in basin from the, call it, $0.90 you see today closer to like $0.50, $0.60, I think we’re pretty open-minded about adding more exposure back in basin. It also just depends on when that is, what the remaining supply picture looks like, we have a view that you get towards the end of this decade, the Utica is also pretty thin on inventory, kind of like the Haynesville.

And so again, I think you just see a paradigm shift at that point in time where you have 30 Bs of LNG becomes fully absorbed in the global market. You have all these power plants, data centers starting to really pull real demand. At the same time you see inventory rollover that will also structurally reset the market higher. And it’s really a point in time we’re kind of laying the groundwork to position for where if we do grow, all of a sudden, you’re going to see a paradigm shift in pricing. And that growth we add is going to be worth a tremendous amount.

Jacob Roberts

Okay. So there’s nothing precluding you from moving gas wherever you want it, I guess it’s the other way to ask that question. .

Jeremy Knop

Correct.

Operator

And your next question comes from the line of John Annis with Texas Capital.

John Annis

For my first one, the 2 supply agreements announced are for projects located in Southwest Appalachia, how would you characterize the opportunity set for EQT to secure similar agreements in Northeast PA? Or is the Southwest just more attractive with your midstream assets there?

Toby Rice

I think you’re going to see the opportunities anywhere you have EQT footprint. And that footprint can come from our midstream infrastructure. The footprint can also come from our commercial opportunities. It seems like there’s a big gravitation of the tech community in Southwest Appalachia. And so we’re seeing a lot of opportunities there. But I mean, our footprint is pretty massive. So we are seeing opportunities across the horizon.

Jeremy Knop

Yes, there’s also nothing that precludes us from building a, for example, 20-mile lateral off someone else’s pipeline to tie into a new power plant or data center as long as our traders can secure the capacity on the pipelines and make sure we get volume there 12 months out of the year at a price that makes sense. So again, I think between our trading arm and our midstream side of the business in addition to our own equity volumes, we have a ton of flexibility.

John Annis

I appreciate it. And then just a quick housekeeping item on the tax front. With the tax rule changes and recently passed legislation, how does that change your outlook for cash taxes over the next couple of years?

Jeremy Knop

Yes, that’s a great question. I actually tees up some important color that we did not cover in prepared remarks. So just the tax bill alone saves us in the next couple of years about $500 million in taxes by deferring that out. Present value, that’s about $450 million. So logically, that’s very front-end weighted in that 5-year window. But that is also before the impact of a lot of the spending, like this $1 billion opportunity. For FERC-regulated projects, which is approximately like the MVP related projects are about half of that $1 billion for perspective, FERC assets are normally depreciated under like a 15-year maker type schedule. But the rest of that is gathering CapEx.

And under that new bill with the — which really bring back bonus depreciation up to 100% effectively all that CapEx, we can expense day 1 and defer taxes on. And so as we ramp into this, whether it’s the midstream side or then it’s the upstream side with IDCs, it actually serves to push taxes off in time for us because taxes otherwise were going to become a pretty large expense over the next couple of years. So it’s really timely for that bill to happen and that’s also the look into growth because it will minimize that cost line item for us that we otherwise were anticipating.

※주의사항※

이 블로그는 전문 투자자가 아닌 개인이 운영하는 블로그입니다. 미국, 국내, 다양한 기업에 대한 투자 정보를 포함하고 있습니다.

블로그 포스팅에는 실제와 다른, 부정확한 정보가 포함되어 있을 수 있으며 블로그 운영자인 저는 작성된 포스팅 내용의 정확성을 보장하지 않습니다. 이 블로그의 정보를 기초로 실행된 투자에 대해 이 블로그 및 저는 어떠한 책임도 지지 않습니다. 포스팅 정보를 기초로 실행된 모든 투자의 책임은 투자자 본인에게 있습니다. 이 블로그는 저 스스로의 공부를 위한 공간이며 방문자님들의 공부를 위한 공간이기도 합니다. 단순한 지식 확장을 위한 공부 이외의 용도로 이 블로그를 이용하는 경우 저는 어떠한 책임도 지지 않습니다.

블로그 포스팅은 모두 10-K, 10-Q, 8-K 등 SEC에 공시된 공개된 문서를 기초로 하며 해당 정보를 제가 가공하여 작성됩니다. 모든 포스팅의 저작권은 이 블로그 운영자인 제 자신에게 있습니다. 포스팅 내용을 지인과 공유하는 것은 정말 감사한 일입니다만 포스팅 내용을 그대로 또는 조금 변형하여 자신의 블로그에 올리는 행위, 개인적인 목적 이외에 사용하는 행위는 저작권법에 의해 처벌될 수 있습니다.

언제나 이 블로그를 방문해주시는 방문자분들께 진심으로 감사드립니다.