소개

TGT는 B2C 소매 전문 기업으로 중산층 이하 고객들을 대상으로 식음료, 가전, 의류, 완구, 뷰티, 헬스, 필수소비재 등 매우 다양한 제품을 판매하는 기업. 그렇다고 다이소나 DG, DLTR처럼 저렴한 제품을 판매하는 것은 아니고, 나름 괜찮은 품질의 제품을 개인 고객들에게 판매하는 비즈니스 모델.

즉, 일반 대중의 소비 심리와 경제의 전반적인 상황을 알 수 있는 좋은 기업.

이들 기업이 가이던스를 하향하거나 좋지 못한 실적을 발표하면 긴장을 조금 해야하는 풍향계 정도 되는 기업이라고 할 수 있겠음.

바로 어제 컨퍼런스 콜이 있었기 때문에 미국 경제 상황을 파악해보기 위해 읽어보기로 함.

요약

Fiscal 2026부터 CEO 교체. 이유는? 실적 부진.

재고 비용 증가와 관세의 일시적(one time cost)라고 이야기함. 구체적으로 보면 관세 비용에 대해 주문 취소 비용이라고 함. 즉, 아직 관세로 인한 마진 감소 또는 가격 인상(수요 감소)에 대한 이야기는 없었음. 질문에 답하면서 상당히 조심스러운 태도. 즉, 시장은 가이던스 실망 뿐만 아니라 경영진의 이런 모습에 실망했는지도 모름.

사업 분야별로 실적이 잘 나온 부분도 있음.

ChatGPT에게 적절히 질문했더니 위와 같은 답변을 줘, 포스팅함.

결론적으로 말하면, 관세로 인한 인플레이션이나 수요 감소, 또는 마진 감소 효과는 아직 명확히 나타나지 않았음.

하이라이트

Target Corporation (NYSE:TGT) Q2 2025 Earnings Conference Call August 20, 2025 8:00 AM ET

Company Participants

Brian C. Cornell – Chairman of the Board & CEO

James Lee – Executive VP & CFO

John Hulbert – Vice President of Investor Relations

Michael J. Fiddelke – Executive VP & COO

Richard H. Gomez – Executive VP & Chief Commercial Officer

Conference Call Participants

Corey Tarlowe – Jefferies LLC, Research Division

Edward Joseph Kelly – Wells Fargo Securities, LLC, Research Division

Joseph Isaac Feldman – Telsey Advisory Group LLC

Katharine Amanda McShane – Goldman Sachs Group, Inc., Research Division

Michael Lasser – UBS Investment Bank, Research Division

Rupesh Dhinoj Parikh – Oppenheimer & Co. Inc., Research Division

Simeon Ari Gutman – Morgan Stanley, Research Division

Brian C. Cornell

Thanks, John. While today’s call was scheduled to discuss our second quarter earnings. I want to start with a bigger headline. The announcement that the Board of Directors has unanimously elected Michael Fiddelke to become Target’s next CEO and to join the Board at the start of our 2026 fiscal year.

The Board chose Michael through a deliberate and thoughtful succession planning process, which took place over the last few years. As part of this process, the Board conducted a rigorous search through which Michael skills, experience and qualifications were thoroughly evaluated alongside a strong list of both external and internal candidates.

Today’s announcement is an important milestone in the history of our company. And I’m confident that Michael is the right candidate to lead our business back to growth. Since I arrived at Target, I have consistently relied on Michael’s strategic insights and sound judgment when making decisions. And he has played a critical role in advancing the key initiatives that have grown and sustained our business.

Michael knows how our business can perform and what our team can deliver when we’re at our best and he’ll bring that confidence along with an aggressive mindset for change into the CEO role. Through a wide range of career experiences, Michael has developed a deeper knowledge of our business and greater insight into our organization than anyone I know. Importantly, through these experiences, Michael has forged deep relationships and built strong trust across the organization and I’m confident the Target team will enthusiastically embrace his leadership.

As I look back on my time at Target, I’m proud of what our team has accomplished as we worked to evolve and grow our business in countless ways. By making significant investments in our team and our physical and digital assets, we built the right foundation on which Michael and the rest of our leadership team can deliver strong performance in the years to come. At the same time, I share Michael’s passion and urgency to accelerate our performance and build new momentum in our business. Results over the last few years have fallen short of our expectations and our potential. That’s why Michael has been engaging the entire leadership team in an effort to refocus our strategy and assess how we’re functioning as an organization and provide the launch pad to reestablish Target as a premier leader in retail.

Included in this work is the Enterprise Acceleration Office that we launched last quarter and which Michael will continue to lead. The team is building out specific plans to address the attributes of our working model that slow us down in an environment that demands more speed and agility than ever before. In particular, we know that process and technology opportunities at headquarters get in the way of a great guest and team member experience. And that’s where we’re focused first. Michael will share more of these initial insights in a few minutes, but I want to stress that this is a longer-term effort that’s focused on finding new and sustainable ways of working that can serve us for years to come. And the way our team has worked together this year to navigate through a volatile and uncertain tariff environment provides a vivid example of how our team can perform when we remove barriers and coordinate our efforts across the business.

As one of the largest importers in the country, the prospect of higher tariffs meant we were facing some major financial and operational hurdles as we entered the year. This was further complicated by the multiple changes in tariff policy that have been announced and implemented as the year has progressed. Addressing these challenges has required close coordination between our merchandising, supply chain, stores and finance teams.

This broad cross-functional group has developed and rapidly implemented countless revisions to our product and inventory plans involving our assortment, product development, sourcing, receipt timing, supply chain flow, order quantities and pricing. While the tariff environment remains challenging and highly uncertain, the team has made significant progress in mitigating their impact on the P&L, while maintaining our focus on value by limiting the impact on our pricing. And while we expect this year’s P&L will reflect some short-term pressure from tariffs, we expect to end the year in a healthy position and move beyond this period of uncertainty in 2026.

And as you’ll hear from the team over the next few minutes, we saw clear indications of progress in our business in the second quarter, as traffic and comp trends improved meaningfully from Q1, particularly in our stores. In addition, we’re continuing to see improvements in quality measures surrounding the store experience, including on-shelf availability. And we continue to see particular strength in our business when guests find newness and innovation in our assortment, most notably in gaming, toys and trading cards this quarter. I want to pause and thank our team for their efforts to deliver these encouraging results, while simultaneously working to minimize the impact of tariffs on our guests and our business.

As I’ve traveled and visited stores and distribution facilities in recent months, I’ve been inspired by the positive energy I’ve seen throughout our team, and their hunger to build on this momentum in the back half of the year and beyond. And to be clear, while we were happy to see improvement in Q2, we are far from satisfied with where our business is performing today. We need to do better, and our entire team is focused on consistent execution, building further momentum and getting back to profitable long-term growth. And we’re confident that we have the right foundation for this effort.

Nearly 2,000 well-located, well-maintained stores located in all 50 states, a $31 billion owned brand portfolio, supported by best-in- class product design, development and sourcing capabilities, an assortment that includes best loved national brands in every category and world-class brand partnerships, including Apple, Starbucks, Levi’s and Champion, a growing and profitable first-party digital business, which provides the fuel for rapidly growing high-margin businesses like Roundel and Target Plus. One of the biggest loyalty programs in the country in Target Circle, which offers a growing list of services, including personalized discounts, same-day delivery and 5% off when using our credit and debit cards and of course, an outstanding global team united in supporting our guests and each other.

Surrounding all these assets, capabilities and our team, we’re fortunate to be part of an iconic brand that’s developed a unique relationship with American consumers. It’s a relationship we should never take for granted. We need to continually invest and evolve how we serve our guests. Just as their wants and needs will continue to evolve over time. I am confident that under Michael’s leadership, the team can strengthen the Target brand and deliver profitable growth. And I’m firmly committed to supporting Michael and the entire Target team as we work together to improve our performance, finished the year strong and enter 2026 with renewed momentum across our business.

With that, I’ll turn the call over to Michael.

Michael J. Fiddelke(Fiscal 2026부터 CEO)

Thanks, Brian, and good morning, everyone. I’m honored and eager to step into the role of leading the company that I love and truly believe in. As Brian outlined earlier, I’ve been fortunate to serve in a broad range of roles and functions over my 20 years here. I’ve learned from every one of these experiences with each giving me a deeper appreciation for the specific ways that Target is special and strategically distinct in a crowded retail landscape. It means I’ve seen how our business can perform when we’re at our best, and

therefore, where we also have clear opportunities today to improve our performance, and we must improve. I know we’re not realizing our full potential right now. And so I’m stepping into the role with a clear and urgent commitment to build new momentum in the business and get back to profitable growth.

In partnership with Brian, the Board and my colleagues on the leadership team, we’re taking a clear-eyed approach to the work in front of us to understand where we need to lean in and where we need to accelerate change. My work over the past few months leading the Enterprise Acceleration Office has also provided a fresh opportunity to broadly assess where we’re at and where we need to go across the enterprise. But even as this work is ongoing, I’ve established 3 key priorities to help us reinforce what will continue to set us apart for years to come. I strongly believe in our differentiated place in retail. At our core, we are a style and design-led company, we’re merchants at heart who love product and win through offering a unique assortment.

So first, we must reestablish our merchandising authority in a way that is distinctly Target. Second, we’re a retailer that believes that an elevated experience is every bit as important as product. We want guests to find a sense of joy from every trip to Target and we must do that more consistently and frequently. And third, we must more fully use technology to improve our speed, guest experience and efficiency throughout the business. Let’s unpack these in a bit more detail. Beginning with our assortment, industry-leading style and design has long been one of the most critical attributes that makes Target, Target, and we need to reclaim that merchandising authority.

As you’ve seen over the last few years, even when overall results have fallen short of our aspirations, we’ve shown how strongly our guests respond when we offer the right blend of quality, value and style not seen anywhere else in the market. To reestablish our leadership here, we need to go beyond the occasional design partnership our new product launch and ensure we’re bringing this authority across each category in our business throughout the year. That will require change, and that change is happening.

As an example, we’re already well underway in building FUN 101, our name for the transformation within our Hardlines categories in which we’re reshaping the assortment in an unmistakably Target way. I know Rick plans to share some specific examples shortly, but we’re already seeing positive comps and traffic growth in these categories, all from leaning into style and culture in much the same way we’re known for in our apparel assortment. Looking ahead, we need to push much harder in bringing this approach to our home category. And to be clear, even a category like food and beverage plays here. And we have a fantastic opportunity to further build on the newness and differentiation our loved owned brands and national brand partners provide in food.

In addition, across the entire assortment, we have an opportunity to further leverage our merchandising authority through our more than $31 billion own brand portfolio. where we’ve spent decades building and refining our industry-leading design and sourcing capabilities. The team behind these capabilities truly puts us in a category of one in our ability to read, shape, scale and deliver emerging merchandising and style trends at incredible value. Beyond the assortment we sell is how we sell it, through an elevated and joyful shopping experience, both in stores and online that powers love for the Target brand all day every day.

We can never take for granted the love our guests show us when they affectionately refer to their local store as my Target. That’s loyalty we need to consistently go out and earn from well stocked shelves and clean stores to a friendly and helpful team and an online experience that brings inspiration and discovery, we want to delight our guests who shop with us every time they shop. And as I’ve made clear, we have to do better here, especially in the consistency of our experience.

And while we certainly aren’t done, that progress is happening. Across the entire assortment and in particular, key items that should never be out of stock our on-shelf availability metrics in Q2 were the best we’ve seen in years. We’re also seeing far greater consistency in our intra-day inventory reliability as well as between weekdays and key weekend shopping windows. We will continue to build on this momentum.

Finally, while technology is at the core of all our operations today, it will need to play an even stronger role going forward. As we continue investing in our future growth, we’ll be making key technology investments throughout our stores, supply chain, headquarters and digital operations to power our team and our business.

Over my career, I’ve seen how critically important it is to continually reevaluate strategies and stay in step with the evolving consumer expectations and trends. And I’ve seen firsthand the impact as bold leaders like Brian have made strong decisive choices to not only meet the needs of today, but to tap into the potential of tomorrow. But despite the solid foundation that’s been established our performance over the last few years has not been acceptable. While we’re proud of the many ways that Target is unique in American Retail, we have real work in front of us. And to be blunt, we need to move faster, much faster, and we are.

As Brian mentioned, over the past few months, we’ve been urgently adjusting our approach to assortment planning amidst a rapidly evolving external tariff and consumer landscape. This type of speed and agility is exactly how we need to lead across all aspects of our business, serving as a textbook model for our new enterprise acceleration office. While the work of this office is just beginning, we’ve

already identified areas of opportunity, and we’re acting on them with a focus on leaning into and embracing the role of technology in greater ways across all of our operations. We’ve identified the biggest challenges that slow us down, legacy technology that doesn’t meet today’s needs, manual work that can be automated, unclear accountabilities, slow decision-making, siloed goals and a lack of access to quality data. For example, it’s clear that at our headquarters, team structures and processes have significant opportunities to improve.

Everything we do should be in service of our guests, and we’re evaluating how to best ensure our resources and talent better align with our strategy to drive speed, quality and consistency in support of the tens of millions of guests that shop us each week. This evaluation requires that we take a hard look at where, when and how we work. We started redesigning large cross-functional processes like how our teams build our merchandising and inventory plans to clarify roles and access the right data to make more effective decisions. And while we still believe in the flexibility of a hybrid workplace, we’ve set the expectation that our team should be working in-person more often so they can collaborate more effectively across team lines and solve problems more quickly.

We’re also improving in embedding more technology and data within our team to get that work done and moving quickly to evaluate every one of our tech initiatives determining which have the highest return and are most mission-critical so we can realign resources accordingly. For example, by leveraging AI and other tools, our team can build an update forecast more accurately while spending less time creating them. So we’re investing to deploy the power of AI more fully across our team, freeing them up to spend more time bringing joy to our guests.

Since our last earnings call, we’ve deployed more than 10,000 new AI licenses across our team, and there’s more to come. These are just a few examples of the work we’ve done so far and the focus we’ll have going forward. Solving these challenges will require changes, both big and small, across technology and data, process and structures and organizational behaviors. And I’m committed to ensuring our teams clearly understand our priorities and are relentless in our pursuit back to growth. As I get ready to pass things over to Rick, I want to thank our team for continuing to show up for our guests, our stakeholders and each other and for the progress you delivered in Q2 that we’ll build on going forward. I share your hunger to win, and I’m committed to helping us do just that.

Brian, thank you for your stellar leadership and mentorship over more than a decade. For the Board, thank you for the trust that you have placed in me to lead this company. And to our shareholders, thank you for your continued interest and support of our business. I’m eager to continue this conversation with you in the years to come. Each quarter, we will continue to provide meaningful updates, and I hope you’ll feel the urgency that I see across this team to move this company forward, back to growth, back to our style authority and back to a shopping experience that helps all families discover the joy of everyday life.

With that, I’ll turn the call over to Rick.

Richard H. Gomez

Thanks, Michael, and I want to offer my congratulations to you as well. I’m excited about what this announcement means for Target, and I look forward to continuing to work with you as we collectively write the next chapter for Target.

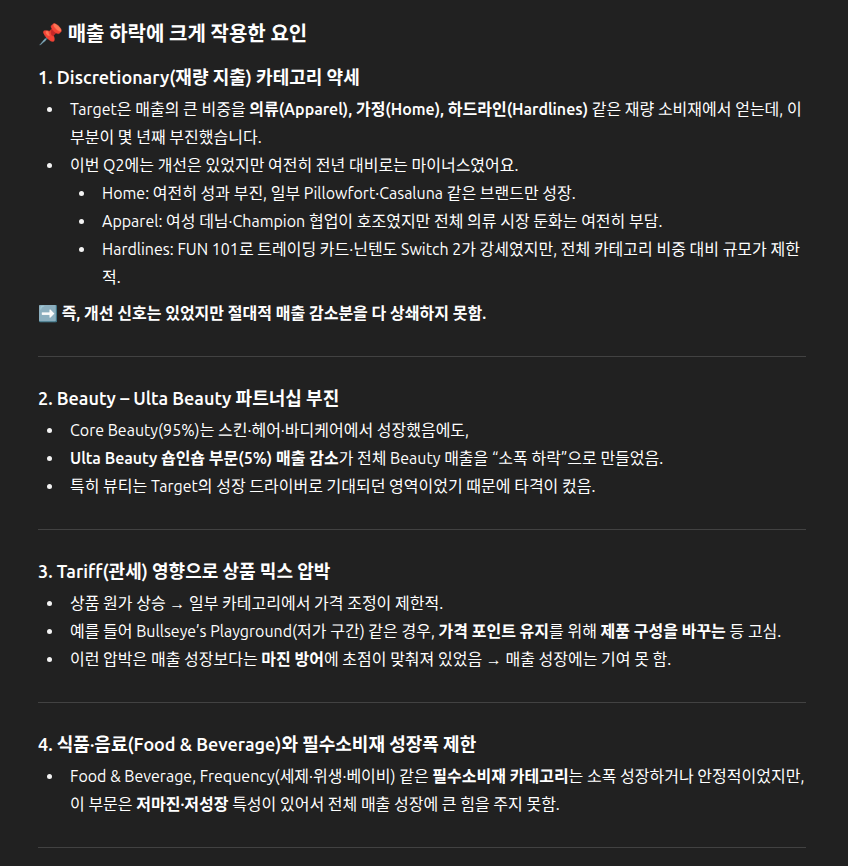

Brian, I also want to thank you for the opportunities you have provided me and the lessons I’ve learned under your leadership. Thank you for all you have done for me personally and for all of us at Target. Turning to our second quarter results, which demonstrated some tangible signs of progress on our path back to growth. While our current performance is far short of our aspirations, we are pleased with the sequential improvement we saw across each of our 6 core categories from the first to second quarter, led primarily by improvements in store traffic trends. In total, for the second quarter, comparable sales were down 1.9%, a nearly 2 percentage point improvement to Q1.

Sales trends were strongest in the digital channel, where comparable sales grew 4.3% with notable strength in same-day delivery powered by Target Circle 360, which grew more than 25%. In terms of category performance, you’ll notice a familiar theme to what I’ve shared in prior quarters. How newness and style forward product at an incredible value continues to be what resonates most with our guests.

In Q2, performance was led by FUN 101, our updated approach to bringing greater style and cultural relevance to our Hardlines assortment. With this new approach, we saw growth of more than 5% in Q2, our strongest quarterly comp in this category since 2021. One notable area of strength within FUN 101 was in trading cards where we’ve been leaning in, given the cultural relevance and wide appeal to young fans and adult collectors alike. As a result of doubling down on this assortment, trading card sales are up nearly 70% year-to-date, driving hundreds of millions of dollars of incremental sales, making us a top market share player in this category and putting trading cards on track to deliver more than $1 billion in sales this year.

Also in FUN 101, trend forward tech accessories like brightly colored headphones and phone cases and toys priced under $20 are leading to share growth in these categories(소득세 인하 기대감 때문일까?), a trend we intend to build on in the coming quarters. And of course, within Electronics, we saw an incredible response to the launch of Nintendo Switch 2, in which we were among the top retailers in terms of overall sales and market share performance. The affinity between the Nintendo and Target brands has long been incredibly strong, and we are excited about the continued strength we expect to see in the back half of the year, both from hardware sales as well as the attachment of software and related apparel, toys and collectibles.

Food and beverage categories grew slightly year-over-year driven by newness and floral offerings around key moments like Mother’s Day, along with new trending flavors throughout the assortment, including beverages, ice cream, snacks and other backyard barbecue essentials. In Q2, beauty sales were down slightly though we did see many bright spots throughout the assortment. In our core beauty assortment, which represents more than 95% of our total beauty sales, we saw notable strength in skin, bath and hair care categories, which all grew low single digits. Before turning to our expectations for the balance of the year, I want to spend a little time sharing an update on our recent announcement in which we mutually agreed with Ulta Beauty not to renew our partnership when it concludes in August of 2026.(이것 때문에 전체 매출 감소지만, Ulta Beauty를 제외한 beauty sales는 여전히 강했다는 이야기)

Trends and expectations can change rapidly across virtually every sector of retail, but this is particularly true in beauty. We’re proud of what we were able to accomplish in our partnership with Ulta Beauty and we’ll both continue to focus on providing an inspirational shopping experience for the remainder of our partnership. Over time, in light of shifting consumer trends, we believe we have a compelling opportunity to repurpose this space to meet those changing needs. As we turn the page to Q3 and beyond, we’re already well into the back-to-school and college seasons, a particularly important time for our guests and Target’s second largest seasonal moment of the year. While a lot of the season is still ahead of us, both back-to-school and back to college are off to encouraging starts.

Guests are responding to our value offerings, including essential school supplies, where we’ve maintained last year’s prices. From $5 backpacks to $0.50 boxes of Crayola Crayons, we want to ensure students will have everything they need for a successful start to the school year. And we’re showing up for the true classroom heroes as well by offering teachers exclusive discounts and support with school registries for everything they will need for the year. In fact, this year, we have seen hundreds of thousands of teachers take advantage of our registry program, up significantly from last year.

On the back-to-college front, our style forward mix and match dorm sets at unbeatable prices are doing well and showcase yet again the importance of providing style, quality and affordability within our assortments. And as students and nonstudents alike look to refresh their wardrobes, we’re so excited about our latest collaboration, Champion for Target. Having launched just over a week ago, early signs suggest this is going to be very popular with our guests and initial sales trends are better than we originally expected, including more than 500 stylish sports-inspired items across apparel, accessories, footwear and sporting goods for kids through adults, this collection is designed exclusively for Target and blends Champion’s iconic heritage with the modern design and premium fabrics consumers expect from Target.

And as the seasons turn from warm summer days to cool fall nights, we are excited about our plans for all of the remaining seasonal moments that are just around the corner, including our plans for Halloween and the Q4 holiday from pumpkins to throw blankets and decor to Halloween candy and costumes, we are delivering incredible amounts of on-trend in newness and value throughout this year’s assortment.

In fact, nearly 1/3 of this year’s Halloween candy assortment is new and around 75% of our home assortment is new as well. While we are planning cautiously for the back half of the year, given continued uncertainty and volatility, that won’t stop us from leaning into what consumers want, ways to amplify and celebrate the seasons affordably with family and friends without sacrificing on style or quality. From managing through a rapidly changing tariff landscape to developing assortments that match the wants and needs of the moment, I am constantly inspired and impressed by our team and the passion and care they show for each other and our guests in all that they do. Thank you, Team Target, for your unwavering dedication to bring joy to the lives of the tens of millions of guests we are fortunate to serve.

With that, I’ll turn the call over to Jim.

James Lee

Thanks, Rick. I also want to offer my congratulations to both Michael and Brian. One of the many reasons I chose to come to Target was the opportunity to serve on the leadership team with both of you, and I’m excited about the opportunities ahead of us to accelerate our performance in the quarters and years ahead. In the second quarter, net sales were down 0.9% from a year ago. This was nearly

2 percentage points better than our Q1 performance, led by an even stronger improvement in our store sales trends. Both traffic and basket trends improved as well.

As Rick covered earlier, we continue to see healthy growth in digital. And within our non-merchandise sales, Roundel, Target Plus and membership all delivered double-digit growth compared with last year. Across the months of the quarter, sales trends were notably stronger in June and July than they were in May. And for the 35 subcategories for which we track market share, we’ve gained or held share in 14 so far this year. While we are far from satisfied with this performance, we were encouraged to see improvements in our share performance in the latter part of the quarter, giving us confidence that trends have stabilized and are positioned to move in the right direction.

Our second quarter gross margin rate was 1 percentage point lower than a year ago. This decline was primarily the result of about 210 basis points of pressure within merchandising, reflecting inventory adjustment costs related to the slowdown in our first quarter sales combined with the tariff-related pressures including purchase order cancellation costs. These pressures were partially offset by improvements in inventory shrink worth about 130 basis points of benefit in the quarter.

For the full year, we continue to expect about 80 basis points of operating margin rate benefit from lower shrink, which when combined with the 40 basis points of benefit last year, will bring this year’s shrink rate down to pre-pandemic levels. I also want to pause and comment on our Q2 ending inventory, which was about 2% higher than a year ago. This increase was driven by purposeful investments in our frequency categories to support in-stocks and other reliability measures.

In addition, this year’s inventory reflects higher product costs than a year ago, driven by tariffs and other pressures. As such, our Q2 ending inventory units saw a low single-digit decline versus last year. Bottom line, having completed the necessary inventory adjustments we had planned for the first 2 quarters of the year, we feel good about our inventory position as we enter Q3. Moving down to expenses on the P&L. Our second quarter SG&A dollars were 0.1% lower than a year ago, driven by strong expense control across the organization. I want to thank the entire Target team for their continued cost discipline and focus on efficiency in an environment where we are facing challenges on the top line.

At the bottom of the P&L, the business generated GAAP and adjusted EPS of $2.05 in the second quarter compared with $2.57 a year ago. It’s notable that the vast majority of this decline was driven by the combined impact of inventory adjustment costs and tariff-related costs. Looking ahead, we expect more favorable comparisons in the back half of the year as we’ve already made all the necessary inventory adjustments and expect that the bulk of this year’s onetime tariff costs are also behind us.

Before I turn to capital deployment, I want to briefly cover our after-tax return on invested capital, which measures the quality of our investment decisions over time. For the trailing 12 months through the second quarter, our business generated an after-tax ROIC of 14.3%, while this is a strong after-tax return on an absolute basis, it’s one of the many financial measures we expect will improve over time.

Turning to capital deployment. I want to quickly reiterate our priorities, which have been consistent for decades. First, we fully invest in our business and projects that meet our strategic and financial criteria. Second, we support the dividend and look to build on our decades-long record of growing the per share dividend annually. And finally, once the first 2 goals have been satisfied, we look to deploy any remaining excess cash to repurchase shares over time within the limits of our middle A credit ratings.

Regarding the first priority, we’ve invested approximately $1.9 billion in capital expenditures so far this year and continue to expect full year CapEx in the $4 billion range as we open new stores, remodel existing ones and invest in our supply chain and technology, all in support of our goal to deliver a fast, reliable and differentiated shopping experience for our guests. Regarding the second priority, we returned just over $500 million in dividends to our shareholders in the second quarter and the upcoming Q3 per share dividend will reflect a 2% increase that was approved by the Board of Directors in June. Regarding the last priority, given the uncertainties we are facing most notably from tariffs, we did not repurchase any shares in the second quarter.

However, given the performance of the business in Q2 and the agility our team has demonstrated in navigating the tariff environment, we should have the capacity to repurchase shares in the back half of the year. However, we’ll approach this activity cautiously and remain steadfast in our goal to maintain our middle A credit ratings. Looking ahead, we’re maintaining our full year guidance, which anticipates a low single-digit decline in our comparable sales, GAAP EPS of $8 to $10 and adjusted EPS of approximately $7 to $9. While our Q2 performance reinforced our confidence that we can deliver on that guidance, we’re still facing a highly volatile and uncertain environment and believe it’s prudent to maintain a cautious approach in the back half of the year.

Before I turn the call back over to Brian, I want to make a brief comment on my new role in leading our strategy team. One of the primary functions of a strategy team is to help the company prioritize and deploy resources to maximize the long-term performance of

the business. And while our work as a leadership team to refocus our strategy is ongoing, I’d like to build upon Michael’s comments on areas that are clear themes.

First, we will continue to leverage our stores as fulfillment hubs. It’s an incredibly fast, efficient and capital-light approach to running an omnichannel business and to ensure our store teams can deliver an outstanding in-store shopping and digital experience, we’re investing in technology and process improvements to further streamline the fulfillment process.

Second, as Michael covered, we need to make decisions and work more quickly in an increasingly dynamic and unpredictable environment. This involves changing how we work and make decisions and applying a continuous productivity mindset in order to fuel investments including the rapid deployment of technology solutions to operate more efficiently and win in the marketplace. Third, we will lean further into the aspects of our business where we are already strong and differentiated, including style and design and the shopping experience. And within our merchandise assortment, we have an opportunity to further amplify areas of strength and market share leadership, areas that include baby and kids, swimwear, beauty, health and toys.

And finally, you will see us lean further into our role as an accessible partner for other brands, vendors and retailers. We already benefit from strong partnerships with vendors, including Starbucks, Apple, CBS, Disney, EssilorLuxottica and Champion. We see an opportunity to lean further into those relationships while being open to new ones down the road. Another example is our recent decision to invest in the more than 100 retail partners on our ship to marketplace by eliminating markups on same-day deliveries from their stores. Target’s desirability as a partner is a unique attribute of our brand and the way we go to market, and we’ll be looking for more opportunities to leverage that strength in the years ahead.

Now I’ll turn the call back over to Brian and Michael for some closing remarks.

Brian C. Cornell

Thanks, Jim. For the past 11 years, I’ve concluded each of our earnings calls before moving to your questions. Today, I’ll pass the baton to Michael to share his closing thoughts. I want to thank each of you for your engagement over the past 11 years. And I look forward to speaking with you one last time during our third quarter earnings call. Michael, over to you.

Michael J. Fiddelke

Thanks, Brian. I’m truly grateful for everything I’ve learned from you and eager to bring those lessons to my work with you and the rest of the leadership team as we begin writing the next chapter in our company’s history. Before taking your questions, I want to reinforce a few key points I’ve made this morning.

First, while we’re encouraged by the momentum we’ve been seeing in the business, we’re far from satisfied with our current performance. The entire leadership team is bringing a sense of urgency to our work to return this company to growth. Next, the way we will get there is by being unapologetically and unmistakably target. That means we need to fully recapture our merchandising authority and signature style, elevate the guest experience consistently, both in stores and online and more fully leveraged technology to help us move faster. And standing here today, I am more confident than ever in our future potential.

We have invested heavily over the past decade to position ourselves for long-term sustainable growth, and that is exactly where we’re headed. I’d also like to take a moment to address our teams in our stores, our supply chain buildings and our headquarters locations around the world. I’m incredibly proud of all you do day in and day out to bring joy to the tens of millions of guests that shop us every week. You’re truly the best team in retail. And my aim is to move at pace, with accountability to improving performance and driving growth. Let’s rally together for an outstanding finish to the year and show the world what we can accomplish together in the years ahead. With that, Brian, Rick, Jim and I will be happy to take your questions.

Question-and-Answer Session

Operator

[Operator Instructions] Our first question comes from Kate McShane with Goldman Sachs.

Katharine Amanda McShane

We wanted to — and congratulations both Brian and Michael on the announcement today. We wanted to ask a question focused on price. Just what price increases were taken during the second quarter as a result of tariffs? And what your expectation is for the second half?(핵심 질문은 항상 처음에!)

Brian C. Cornell

Rick, do you want to spend some time talking about the pricing environment and our plans for the back half?

Richard H. Gomez

Sure. I can talk about both tariffs and pricing and the outlook for the back half. From a tariff perspective, TAMs are working really hard to mitigate the impact of tariffs and have done a terrific job of mitigating the vast majority. We feel that we are well positioned relative to other retailers given Target size and scale given the flexibility that we have with our multi-category business. And then the fact that we have a world-class global sourcing and design team puts us in a good position to navigate these tariffs.

We are employing several different strategies including diversifying country of production, in some cases, evolving our assortment. A good example of that is Bullseye’s Playground, which we’ve committed to price points of $1, $3 and $5. So we’ve made some changes to the assortment to bring in Beauty Minis to hit those price points. And then, of course, we’re continuing to negotiate with our partners to ensure that we’re offering everyday good value to the consumer. What we’ve said and it continues to be our position is that we’ll take price as a last resort. But our commitment is to offer everyday good value and to have competitive pricing. As we think about going forward, what I would just say is value is very top of mind for consumers right now. They’re looking to stretch their budget. They’re looking to navigate inflation and uncertainty around tariffs.(관세로 인한 수입 가격 상승을 상쇄하기 위해 소비자 가격을 올리기에 부담스러워하는 모습.)

So value is very top of mind and we will continue to offer great value in the form of deals and promos and price, but also consumers are thinking about value much more broadly than that. They’re thinking about it as quality and style and trend. And so we’ll very much be leaning into our own brands, which deliver outstanding value, great pricing, great quality, great trend, great taste as a way to help consumers navigate the challenging macro environment.

Michael J. Fiddelke

Kate, the only thing I’d build on there is just reiterating Rick’s thank you to the team. The way the team has rallied to navigate what’s admittedly been a volatile tariff environment, I think, just shows the way in which when we’re at our best, we’re working together, moving with pace and the work they’ve done to set up a back half of the year where we can sit here today and reiterate the $7 to $9 EPS guidance that we described a quarter ago is a testament to their work.

Operator

Our next question comes from Michael Lasser with UBS.

Michael Lasser

The market has been looking from the outside and asking for a catalyst or an agent for change, how does the succession plan that has been put in place bring about the change that would improve the trajectory of the business? And how soon do you expect it will take to show substantial progress as part of that, does Target being to make any changes to its culture to realize the priorities that have been set forth?

Michael J. Fiddelke

Michael, I’m happy to start. I think it’s an important question. And sitting here today, I think there’s a couple of things that are certainly true for me as I look to step into the role. The first is — there’s real power in drawing on 20 years of knowing what makes Target, Target. Having seen us at our very best in different chapters gives me a clear focus on who we are in retail and what our unique path is that’s going to lead to growth. And it centers on style and design.

You’re going to hear me come back to that over and over. But let me spend just a second more on what that means. That means that we win through incredible product and setting an amplifying trend across all the businesses. Sure, the ones were style and design might jump first to mind like apparel, thrilled with things like our new Champion set and the guest response to that. But I’d argue that it’s true in a category like food and beverage, where our ability to bring newness with our national brand partners, our ability to grow that category on the back of 2 loved owned brands in Favorite Day in Good & Gather that are all about differentiation is the path forward for how we win across every single category. And so you’re going to see me come back to that style and design North Star. And that — like I said, that’s informed on my time with the business and even reinforced by me stepping back over the past few months and looking through the lens of the Enterprise Acceleration office.

You’ll see me pair that North Star with real candor and assessment on where we’re at and where we need to do better. And you can hear that in the 3 priorities I’ve laid out. We need to make sure that merchandising authority is showing up across all of our categories, and there are some categories where we have some work to do and work that’s not wait until February, but work the teams are on now to transform categories like Hardlines, now FUN 101, categories like home, where we’re not satisfied with our performance over the past few years. And so you can expect me to operate with candor, urgency and pace and making the changes that we need to get the growth we expect.

Michael Lasser

My follow-up question is, as the succession plan is set into motion, it is a fantastic opportunity to help properly calibrate expectations about the heavy lifting that will be set in motion. So can you put into context and quantify the investment either in margin and/or capital that will be necessary for Target to close the performance gap with its peers and realize its potential.

Michael J. Fiddelke

You’ve heard us be consistent and Jim be consistent on how we think about capital allocation. And that capital will follow any high- return projects that we see. We’re fortunate to have a strong pipeline of those projects.

Strong pipeline of new stores. I’ve had the chance to visit some of those new store openings this year. And what we’re seeing in terms of performance of the new stores when they open is we’re really pleased with more often than not, those new stores are big box targets. And far more often than not, they’re exceeding our expectations. And so we’ll continue to put capital to work when we can bring a new store to a new market.

Important that we continue to remodel stores. We’ve talked about remodels for a while, but we’ve got several hundred stores that don’t yet have our latest and greatest thinking. That’s an important step forward for those stores where we can expand categories to meet the needs of the business, foods often a category that gets some extra love in terms of more space when we do a remodel, and we can modernize the way we merchandise across every single category when we do those remodels. That will be important. We’ll continue to put capital behind tech. You heard me talk about that is the third of my 3 priorities. And I think we have a real opportunity to use technology more boldly to accelerate the business.

I could not be more excited in the conversations that I’m having with Pratt as he steps into the role leading our technology business this year. The work the teams did under Pratt’s leadership in digital to set a high bar and move with pace to modernize that piece of the business, we get the chance to apply that thinking to our entire technology portfolio right now. And so we’ll make the right investments that drive return, and we’ve done that in the past, and we’ll continue to do so.

Operator

Our next question comes from Corey Tarlowe with Jefferies.

Corey Tarlowe

I had a question just on the long-term growth framework that you’ve laid out. So you introduced the $15 billion of sales growth target over the next 5 years implies roughly low single-digit CAGR. Given the current headwinds, what are the key operational and strategic levers that you’ll pull to achieve this target and how should we think about the trajectory towards this goal with the succession plan announced today.

Michael J. Fiddelke

Well, I appreciate the question that starts with growth because that is the only path for us going forward. It is my sole primary goal as I step into role. And we know that this is a business model that only works when we’re growing, when we’re taking share, and we’re using that to drive the bottom line. That’s the only path that works long term in retail is one that’s built on the back of growth. And so that becomes — me and my team’s sole focus as I step into the job. The path to get there is focused on the 3 priorities I laid out. We need to know who we are and we need to move with speed and urgency against the high bar for what product looks like on our shelves and what the experience looks like. And that’s work that we’re excited to have in flight across the business and moving with pace there will be important.

And we need to take it a quarter at a time. It is good to see progress in the business in Q2 versus Q1. To be clear, you heard each of us say it in different ways. We are not pleased with a quarter that has a negative comp. But to take a step forward across all 6 of our key categories in Q2 versus Q1 is a step in the right direction. We need to build on that momentum as we look at the back half of the year and into next year.

Corey Tarlowe

Great. Just a follow-up on traffic and market share dynamics with traffic, obviously impacting comp and discretionary spending being pressured, what are specific merchandising or pricing strategies that you’re implementing to drive frequency and basket size, particularly relative to key competition in today’s environment where prices of increasing sensitivity among your key customers.

Brian C. Cornell

Rick, do you want to take that one?

Richard H. Gomez

Sure. Let me unpack our performance and give you a sense of what’s driving some of the acceleration that we’re seeing across all 6 of our major lines of business. And I’d start with discretionary. Our discretionary business saw a 400 basis improvement from Q1 to Q2, that’s driven by what we’re calling FUN 101, which was our Hardlines business as we’re strategically moving that into more of a trend forward, culturally relevant business.

The FUN 101 business delivered a 5% comp, and that’s driven by trading cards and Nintendo Switch 2. Apparel, Apparel also saw an acceleration driven by several different things, but I would highlight women’s ready-to-wear, in particular, women’s denim, women’s denim saw a 28% comp, driven by new styles, new silhouette, new washes. And then Home, Home also saw an acceleration driven by newness. Innovation in small appliances like Ninja Shark and then to frequency, I mentioned food and beverage, where our beverage business a 6.5 point comp driven by probiotic sodas, new energy drinks, new seasonal flavors. And then Beauty also saw growth in some key categories. And I’m talking about our core beauty business, which is 95% of our business. We saw growth in skin care, hair care and bath. So really, the common theme through these categories, we’re seeing — when we deliver newness that’s on trend. It’s a stylish at an affordable price point. The consumer reacts and we drive sales. So that’s really what our focus will be for the back half of the year is to continue to deliver that newness at an affordable price.

Michael J. Fiddelke

I think that there’s something that’s important for the long term and the theme you heard Rick amplify there. It is about product and assortment and getting that style and design leadership and newness across the categories. I mean that is the bright spots in the business that we see power in Q2. You can expect much more of that as we remake categories like Hardlines now FUN 101 in home. It starts with product and great product that leads with style and design is where we see strength as we remake some of those categories, that’s where we’re going to lead in.

Operator

Our next question comes from Joe Feldman with Telsey Advisory Group.

Joseph Isaac Feldman

Congratulations, Michael on the CEO spot. So with merchandising, how do you guys change the mindset of the team that’s in place now? Like how do you stimulate that change, I guess, given the existing teams in place. I don’t know, maybe it’s for Rick and Michael, but thanks.

Brian C. Cornell

Joe, I think Rick would be happy to talk about that.

Richard H. Gomez

I’d be happy to talk about it. Style and design is not new to target. Style and design is core to our DNA, and that’s kind of who we are and who we have been. We have built a design team and a sourcing team over decades that live and breathe trend and design. And the way we’re going to build momentum is by building on the green shoots, leaning into where we see bright spots. And I’ll use the home category as an example because we’ve talked a lot about that.

The home business is not where we want it to be, but we do have some bright spots. And Kids home, as an example, Pillowfort. When we did Pillowfort in a collaboration with Disney and Marvel, we saw growth. On Casaluna, which is our premium bedding, we did new colors, new patterns, new fabrics, and we saw growth. Now what the team needs to do is say, okay, we need to do more of that more consistently, more frequently across bigger parts of the business. So right now, the team is very focused on threshold. It’s our largest home-owned brand, and they’ve been working on that, and you will see next year changes across the assortment across categories and what I’m really excited about is not just the product. We’re also changing the experience in store that’s going to facilitate more discovery and inspiration. So that is how we’re building momentum, and we’re going to keep pushing until we can get all 6 of our core major businesses back to growth.

Joseph Isaac Feldman

That’s very helpful. And then just a follow-up on the tariff comments. If I heard in the prepared remarks, I thought you guys said the bulk of the tariff cost is behind. Can you maybe clarify that? Or maybe it was a bulk of onetime tariff cost. Can you just.

Brian C. Cornell

Jim, why don’t you just take that — understand that.

James Lee

Yes Joe, I’d be happy to take that. In Q1, as you might recall, I mentioned 2 primary headwinds facing us in the balance of the year, and that was related to inventory adjustment costs. All of those have been taken care of in the first half of this year. So we are clean from a second half perspective. And then we talked about tariff costs. The majority of the tariff-related costs that we had signaled was related to onetime costs, primarily driven by order cancellation costs except. The vast majority of that hit us in Q2. So you won’t see significant portions of that going forward.(One Time Cost라고 말하면서, 관세로 인해 가격 인상은 없이, 주문 취소로 인한 비용만을 이야기하고 있음. 즉, 가격 인상으로 인한 수요 감소나, 가격 인상을 못함으로서 발생할 수익성 저하와 같은 충격이 앞으로도 지속될 수도 있다는 의미.)

Michael J. Fiddelke

And just to build on that, Joe, to Jim’s point, it’s the onetime things that we’re focusing on there. Obviously, the straight cost impact of tariffs will be with us as long as the tariffs are with us. To build on our inventory position because I do think that’s an important point. We set out a goal to make sure we liked our inventory position as we exited Q2, and we achieved that goal. You’ll see inventory up just a couple of percent on the balance sheet. It’s up more than that, that growth is all coming from investments in our frequency categories. And you’ve heard me say consistently getting more in stock is a key goal of ours.

Some of that inventory investment is in direct support of that goal. We’re actually down in total in units, and we feel well positioned in the discretionary categories with all the facts we have as of today. When we look ahead at our view for the back half of the year, our current understanding of tariffs. And so that positions us well as we step into the back half of the year.

Operator

Our next question comes from Rupesh Parikh with Oppenheimer.

Rupesh Dhinoj Parikh

I guess to start off, just start going back to the full year guidance range. It’s still a wide range on a low single-digit sales decline. So just curious the key factors that can drive results closer to the high end of that range.

James Lee

Rupesh, it’s Jim. Yes, as I mentioned in my remarks, Q2 performance certainly increased and reinforced our confidence of delivering within the $7 to $9 range, but given that there’s still quite a bit of runway left for the year and a lot of heightened uncertainty on — with consumers and tariff uncertainty, we thought it was more prudent just to take a cautious approach and maintain that guidance. And certainly, we’ll be watching this closely.(답변 하지 않음)

Rupesh Dhinoj Parikh

Great. And then maybe my follow-up question. So Michael, just going back to the 3 key priorities that you laid out. Just curious whether you see a need to make additional labor investments to execute on those priorities.

Michael J. Fiddelke

Yes, it’s a good question, Rupesh. And one of the things that we’re spending some time on is looking at how we leverage each store in support of the different parts of the business. And so I’m going to — I’m going to zoom out here for a second to provide some context to what I mean by that. We’ve seen over the last half decade some incredibly good things happen in the business. We built a profitable $20 billion digital business and what feels like it happened overnight in those first couple of years, the pandemic where we saw so much of that growth and there is no doubt in my mind that wouldn’t have been possible without the incredible role that our stores played to support that growth.

They let us support all of that digital business with great speed to our guests. Great, cost, like I said, that profitable business is a result of the economics that come with store fulfillment and in a capital-light way. And so I wouldn’t trade any of those outcomes at all. And we know if you’re a store director today or a team member in stores, the world has gotten more complex in our buildings than it was 5 years ago. You’re juggling that digital business growth and working every day to maintain a great in-store experience. And you’ve heard me say from the start of the year, bringing more consistency to that in-store experience is a key priority of ours.

So some of how we unlock that is stepping back and saying, what roles are best suited to do what thing. We’ve had a test in Chicago running this year where we’ve made some pivots and said some stores are built to fulfill. They’ve got a big back room. We can put a lot of pack stations in the back. They’ve got a manageable level of an in-store business, and they can support that digital demand in a market super well. Some other stores — on the digital fulfillment side, we might say, actually shut your pack station down and sit this one out because that allows you to focus exclusively on the drive-up business and importantly, the order pickup — or importantly, the in-store experience in a store.

We’ve been pleased with what we’ve seen in that test, both on the digital fulfillment side and especially on the store experience side. And so you’ll see us take those learnings and apply them to somewhere between 30 and 40 more markets before the year is out. So I just offer that as 1 example of changing how we use our assets, changing how we focus our store teams can help us make progress on a bunch of fronts.

Operator

Our next question comes from Simeon Gutman with Morgan Stanley.

Simeon Ari Gutman

Congratulations, Michael, and Brian, good working with you over the years. My first question, Michael, at one point, the Target turnaround was talked about more discretionary categories rebounding more external factors. This call sounds a lot more internal. So can you give us a sense, what percentage do you think external versus internal? And then I have 1 follow-up.

Michael J. Fiddelke

So I’ll stop shy of slapping a percentage on each of those, but I think it’s worth acknowledging both. We’ve seen a consumer that had to be choiceful with their spend, we’ve seen inflationary pressure across their household spending. And we know that, that can lead to a pullback in some of the discretionary categories and their discretionary spending. I think, as an industry, we’ve seen a lot of that pressure over the last few years. And so that’s why you’ll hear us talk about staying so close to the consumer and making sure we’ve got that style and newness that cut through and prompt purchase even in a tough environment.

It’s why we’re focused on providing value, yes, inclusive of price. And so those things from a macro perspective continue to be important. And to be clear, we’ve got work to do. We need to make sure we’re leading on our front foot across every single category in our portfolio. The pockets of green shoots you heard Rick talk about, we need to turn those into a field of green shoots. And that’s where the teams are focused. We need to make sure the experience pays off the expectations that our guests have. Some of you have heard me talk about this before. But we know too many of our guests, even with a growing digital business that I expect to grow further, to them, Target is a place. It’s a place that they love. They actually refer to it in pretty unique language because they’ll use the possessive, they’ll say, my Target.

That’s a complement that we take really seriously, and we know we have to go out and earn by delivering a great guest experience, and that’s where you’ll see us focused.

Simeon Ari Gutman

And then with regard to the financial plan, you were part of this year and setting the plan, are you reserving the right to reevaluate? Or are you saying you accept the current run rate? And then if you make investments, you can do so by process engineering, taking cost out on one side to be able to maintain the current run rate of the business.

Michael J. Fiddelke

Well, feel free to pile on to this one, Jim. But we’re always evaluating. I think the goal of a retailer should be nimble. And so if we find new opportunity, you can expect us to talk about it and chase it. We feel good sitting here today that the guidance we laid out a quarter ago, we still see great line of sight to as we look at the back half of the year.

You heard Jim say, there’s a lot we monitor there with respect to the consumer, with respect to tariffs. But we were pleased with the progress we made in Q2, even if we weren’t pleased with the absolute outcome, and we feel good sitting here as we look at the back half of the year. But I’ll reiterate, retail is about being flexible, retail is about being nimble in response to opportunities we find what we see in the consumer, how we can remake our business to better meet those needs. And so that’s a journey that I expect will be on for quarters and years to come. And it’s our job to bring you along when we see opportunity and describe it in the right way. But sitting here today, our outlook for at least the balance of this year is included within the guidance.

Brian C. Cornell

Operator, we have time for 1 last question.

Operator

Our last question comes from Edward Kelly with Wells Fargo.

Edward Joseph Kelly

Michael, congratulations. I wanted to ask you about comp momentum. Maybe could you provide a little bit more color on what you’ve seen in back-to-school? And then as we think about the back half, how are you thinking about the puts and takes? Traffic compares are a touch easier. You probably have some tariff pricing. When are you thinking about when you can get back to positive comps?

Michael J. Fiddelke

Yes. I’m happy to start. We do sit here right in the middle of back-to-school and back-to-college season. And in fact, I got to experience back to college for the first time taking the kids to college. So I was not only a Target leader but a guest in the middle of that season this year. I will say there is perhaps nothing more energizing than getting out in stores during the back-to-college season. And so a huge thank you to all of the store teams, all of the merchandising teams that have stocked us with incredible product for back-to-school and back to college and the way in which that experience is coming through in store right now has just been really a giver of energy and the trips that I’ve been on out in the market over the last couple of weeks.

We’re encouraged by where we sit so far in both of those seasons. And neither of them are done. And so we’ve got a lot of these seasons and important seasons in front of us, but it’s been good to see the guest response. And then back to college specifically, what we see the guests responding to is the trend in style and design leadership. Frankly, we had some opportunities last year with not leading with enough front-footed fashion in our back-to-college assortment, we’ve addressed to that this year, and it’s been great to see the consumer lean in.

Brian C. Cornell

Operator, that concludes our second quarter call. I want to wrap up by congratulating Michael once again. Hopefully, for all of you who are with us today, you realize Michael is day 1 ready to move into this role and I’m really excited to see Michael step into the chair as the new CEO of Target. So thanks for joining us today, and we’ll look forward to seeing you soon.

※주의사항※

이 블로그는 전문 투자자가 아닌 개인이 운영하는 블로그입니다. 미국, 국내, 다양한 기업에 대한 투자 정보를 포함하고 있습니다.

블로그 포스팅에는 실제와 다른, 부정확한 정보가 포함되어 있을 수 있으며 블로그 운영자인 저는 작성된 포스팅 내용의 정확성을 보장하지 않습니다. 이 블로그의 정보를 기초로 실행된 투자에 대해 이 블로그 및 저는 어떠한 책임도 지지 않습니다. 포스팅 정보를 기초로 실행된 모든 투자의 책임은 투자자 본인에게 있습니다. 이 블로그는 저 스스로의 공부를 위한 공간이며 방문자님들의 공부를 위한 공간이기도 합니다. 단순한 지식 확장을 위한 공부 이외의 용도로 이 블로그를 이용하는 경우 저는 어떠한 책임도 지지 않습니다.

블로그 포스팅은 모두 10-K, 10-Q, 8-K 등 SEC에 공시된 공개된 문서를 기초로 하며 해당 정보를 제가 가공하여 작성됩니다. 모든 포스팅의 저작권은 이 블로그 운영자인 제 자신에게 있습니다. 포스팅 내용을 지인과 공유하는 것은 정말 감사한 일입니다만 포스팅 내용을 그대로 또는 조금 변형하여 자신의 블로그에 올리는 행위, 개인적인 목적 이외에 사용하는 행위는 저작권법에 의해 처벌될 수 있습니다.

언제나 이 블로그를 방문해주시는 방문자분들께 진심으로 감사드립니다.