Pinnacle West Capital Corporation 기업 소개

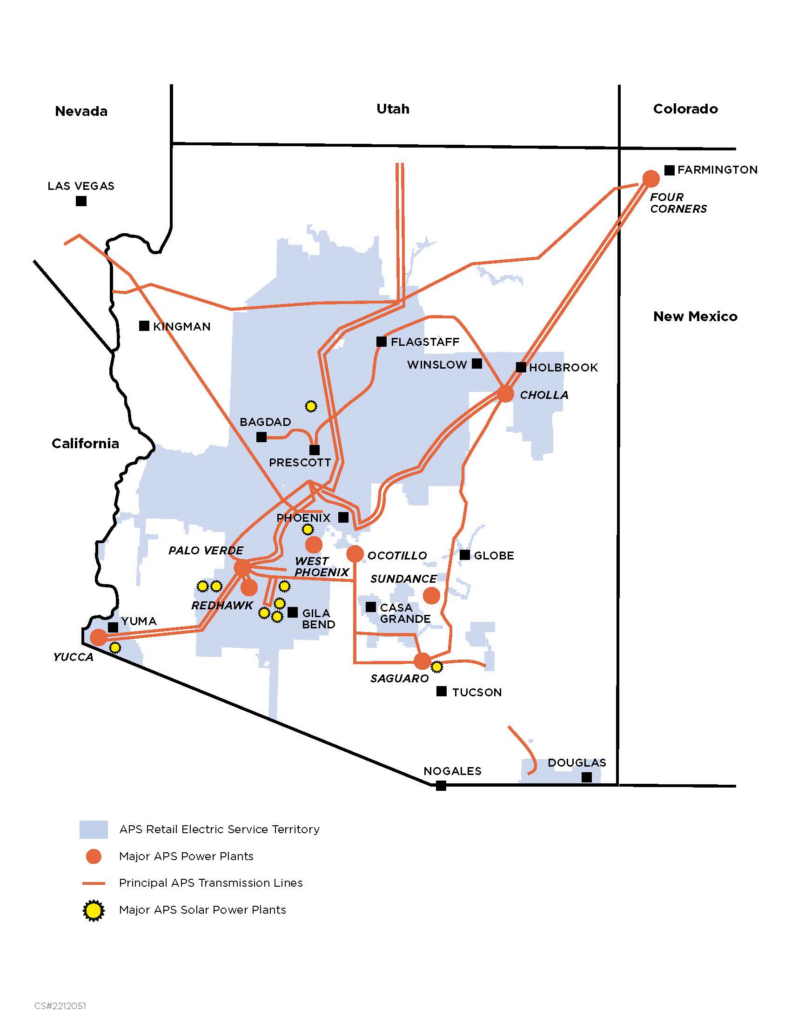

Pinnacle West Capital Corporation(이하 PNW)는 APS(Arizona Public Service Company)를 자회사로 보유한 투자 기업이다. APS는 전력 유틸리티 기업인데, PNW 매출의 100%가 APS로부터 발생되기 때문에 PNW를 단순히 전력 유틸리티 기업이라고 이야기해도 큰 무리가 없을 것이다. 필자가 유틸리티 기업을 살펴 보는 이유는 최근 유틸리티 섹터의 주가가 강세를 보이고 있기 때문이다.

최근 6개월의 흐름을 보면 조금 더 명확한데 유틸리티가 11개의 섹터 중 가장 강력한 모습이다. 그림을 첨부하진 않겠지만 최근 3개월로 보면 유틸리티 섹터는 주택 공급 부족에 시달리는 부동산(Real Estate) 다음으로 2위다. 유틸리티 섹터의 흐름이 좋은 이유는 앞으로 전기 사용량이 급격하게 늘어날텐데 수요를 감당할 전력 인프라, 발전 시설이 부족하기 때문이다. 수요가 공급보다 많으면 기업에겐 좋은 일이다.

PNW를 보는 이유

XLU에 포함된 많은 기업 중 유독 PNW가 눈에 띄었는데, 그 이유는 이 WSJ 기사 때문이다. WSJ 기사에서는 애리조나에서 벌어지고 있는 땅 투기(?)를 다뤘다. 데이터 센터 붐으로 전력 수요가 늘어날 조짐을 보이고 있다고 한다. 이러한 경향을 보이는 대표적인 시장이 Northern Virginia, Atlanta, Phoenix(Arizona 주의 메트로폴리탄 도시), 그리고 실리콘 밸리다. Arizona는 PNW의 자회사 APS가 전력 유틸리티 사업을 독점적으로 하고 있는 지역(state)이다.

데이터센터이 커지며 PNW가 수혜롤 볼 것이라는 간접적인 근거가 위 기사에서 나온다.

최근 Tract라는 기업이 데이터 센터가 들어올 만한 부지를 확보하고 정부의 허가를 받는 사업에 뛰어 들었다. 이 기업은 2,100 에이커(8.5 제곱 킬로미터, 약 가로세로 2.9km x 2.9km)에 달하는 부지를 $136m에 구매했다. 기존에는 $40m 수준에서 거래되던 땅을 세 배가 넘는 금액으로 매수한 것이다. 매수한 뒤엔 APS와 함께 이 지역에 어떻게 전력을 공급할 지, 데이터 센터는 어떻게 지어질 지 연구하고 있다는 것.

두 번째 근거로는 실적이다. 사실 데이터센터 건설 붐이 시작된 지는 몇 년이 지났는데, 실적에서 이 흐름이 나타나지 않았다면 그 기업은 이번 데이터 센터 붐의 수혜를 받지 못할 가능성이 크다. 그런데 PNW의 실적은 상승 중이고, 뒤에서 정리하겠지만 실적 발표에서 매출 상승의 원인이 데이터 센터 및 비즈니스들의 전기 사용 증가라고 밝혔다.

PNW와 유틸리기업의 규제

PNW와 같은 유틸리티 기업이 흥미로운 부분은 바로 규제다. 미국 정부는 아주 미국 다운 방식으로 유틸리티 산업을 규제한다. 바로 ROE를 제한하는 방식이다. 아래 영상을 참조하자. 짧지만 유틸리티 산업을 굉장히 이해하기 쉽게 잘 요약해준 영상이다.

유틸리티 산업은 우리나라도 마찬가지이지만, 전기나 수도 요금이 민생과 직결되는 문제이기 때문에 국영 기업이 독점하는 경우가 많다. 반면, 미국은 민영 기업이 독점하고 있다. 이렇게 정부에서 유틸리티 기업(사기업)의 독점을 허용해주는 대신, 정부 기관과 규제위원회, 기업 관계자들이 만나 최대 ROE를 결정한다.(reg lag docket, 컨콜 스크립트 참조)

다음은 ROE 결정 과정을 잘 이해할 수 있는 실제 2021년 11월 APS의 ROE 결정 과정이다.(Rate Case)

In its initial application, APS had sought a total increase in base rate revenues of ~$184MM with an allowed return on equity of 10.15%. The ACC decision (issued more than two years after the date of the initial application) instead ordered a revenue decrease of ~$120MM with an allowed effective ROE of less than 9% (as compared to a nationwide average of ~9.56% allowed ROE in electric rate cases decided in 2021.) The ACC decision included a ~$216MM prudency disallowance for expenses related to the federally mandated addition of SCR equipment at the Four Corners Power Plant, as well as a 20-basis-point reduction on allowed ROE due to APS’ “customer service performance.” The extremely poor outcome of this case lead to APS suing the ACC and the parties reaching a settlement in June 2023, which allowed APS to raise rates to restore the disallowed SCR expenses and removed the 0.2% penalty to ROE.

예를 들어, 이런 식이다. APS이 다음과 같이 말한다. “이번에는 ROE 상한을 10.15%까지, 매출은 $184m까지 올리게 해주세요. 공해 배출을 줄이기 위해 시설 투자도 해야해요.” 이에 대해 위원회는 “공해 배출 시설 투자는 주정부에서 의무화한 사항이라 예외로 해줄 수 없습니다. 게다가 당신의 기업은 고객만족도 점수가 낮아 오히려 ROE에 0.2%p 페널티를 줘야합니다. 그래서 내년 매출은 $120m이하로 해야하고 ROE는 9% 이상 올리면 안됩니다.” 이를 받아 들이지 못한 APS는 정부를 상대로 소송을 건다.

결국 이 소송에서 APS가 이기긴 했지만 여기에서 바로 regulatory lag이라는 개념이 나온다. 규제로 인한 사업 지연이다. 소송이 진행되는 동안, APS의 사업 계획에 차질이 생기는 것. 그래서 컨퍼런스 콜에서 reg lag docket에 대한 질의 응답이 굉장히 많이 나온다.(아래 컨퍼런스 콜 전문 참조)

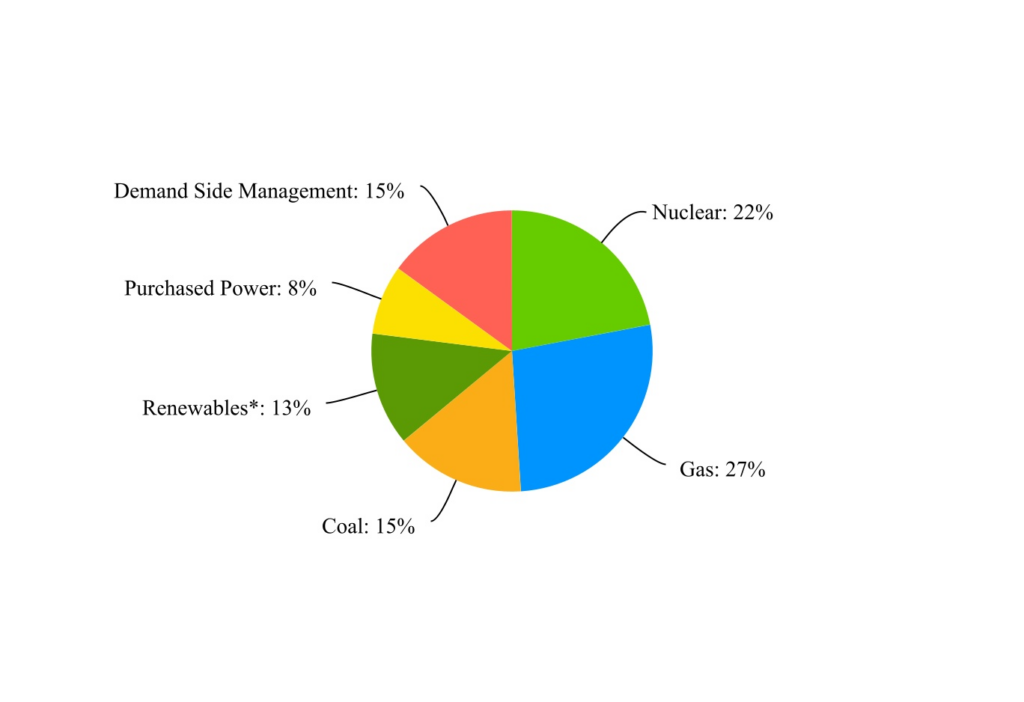

PNW의 에너지 비중과 미래 계획

좌측의 표를 보면, 현재 PNW이 운영 중인 발전소의 비중을 확인할 수 있다. 지금은 석탄과 같은 탄소 배출량이 많은 발전을 하기도 하지만, 2030년까지 클린 에너지의 비중을 65%까지 늘리고, 45%의 전력을 재생에너지로 공급할 예정이다.(참고로 핵발전은 클린 에너지에는 포함되지만 재생에너지에는 포함되지 않는다.)

지금은 13%에 불과한 재생에너지의 비중을 크게 늘리겠다는 것. 한마디로 지역 특성상 태양광 패널과 ESS를 어마어마하게 설치하겠다는 이야기다.

또한 2031년부터는 석탄 발전소 운영을 중단할 계획이다.

2024년 2분기 PNW 컨퍼런스 콜 전문

Pinnacle West Capital Corporation (NYSE:PNW) Q2 2024 Earnings Conference Call August 1, 2024 12:00 PM ET

Company Participants

Amanda Ho – Investor Relations Jeffrey Guldner – Chairman of the Board, President and Chief Executive Officer, Pinnacle West Capital Corporation Andrew Cooper – Senior Vice President and Chief Financial Officer, Pinnacle West Capital Corporation and Arizona Public Service Company Ted Geisler – President, Arizona Public Service Company

Conference Call Participants

Shar Pourreza – Guggenheim Partners Nicholas Campanella – Barclays Michael Lonegan – Evercore ISI Travis Miller – Morningstar Julien Dumoulin-Smith – Jefferies Paul Patterson – Glenrock Associates

Operator

Good morning, everyone, and welcome to the Pinnacle West Capital Corporation 2024 Second Quarter Earnings Conference Call. At this time, all participants have been placed on a listen-only mode. And we will open the floor for your questions and comments after the presentation.

It is now my pleasure to turn the floor over to your host, Amanda Ho. Ma’am, the floor is yours.

Amanda Ho

Thank you, Matthew. I would like to thank everyone for participating in this conference call and webcast to review our second quarter 2024 earnings, recent developments, and operating performance. Our speakers today will be our Chairman and CEO, Jeff Guldner; and our CFO, Andrew Cooper. Ted Geisler, APS President; Jacob Tetlow, Executive Vice President of Operations; and Jose Esparza, Senior Vice President, Public Policy, are also here with us.

First, I need to cover a few details with you. The slides that we will be using are available on our Investor Relations website, along with our earnings release and related information. Today’s comments and our slides contain forward-looking statements based on current expectations, and actual results may differ materially from expectations.

Our second quarter 2024 Form 10-Q filed this morning. Please refer to that document for forward-looking statements, cautionary language as well as the risk factors and MD&A sections, which identify risks and uncertainties that could cause actual results to differ materially from those contained in our disclosures. A replay of this call will be available shortly on our website for the next 30 days. It will also be available by telephone through August 8, 2024.

I will now turn the call over to Jeff.

Jeffrey Guldner

Great. Thanks, Amanda, and thank you all for joining us today. Second quarter financials were positively impacted by a number of things: the implementation of new customers, weather and increased sales growth. Before Andrew discusses the details of our second quarter results, I’ll provide a few updates on recent operational and regulatory developments.

Starting with our operations. As we progress through the summer season, really proud to say our team continues to excel in delivering reliable service to our customers. In fact, we just experienced the hottest June on record in Phoenix with an average high temperature of over 109 degrees and an average overnight temperature of 85 degrees. According to the National Weather Service, the average high temperature in Phoenix during the second quarter was 98 degrees Fahrenheit, which is an increase of 2% over the same period last year and 1.4% above the 10-year historical average.

The number of residential degree cooling days — sorry, the residential cooling degree days, that’s a utility measure of the effects of weather, in this year’s second quarter increased 53% compared to the same period a year ago and was 24% higher than historical 10-year averages. Our robust planning, resource procurement efforts, and our dedicated team have allowed us to provide exceptional service to our customers during this unrelenting summer season. And I really do want to recognize our operators and our field teams for doing an exceptional job making sure our customers continue to have reliable service through this persistent heat.

With the extreme weather we experienced each summer, it remains as important as ever that we continue to assist our communities through heat relief support programs. We partnered with local community organizations to aid the state’s most vulnerable populations, and this support includes a collaboration with the Foundation for Senior Living, where we offer emergency repair, replacement of AC systems during the hot summer months; the Salvation Army’s network of cooling and hydration stations across Arizona and an emergency shelter and addiction protection program in partnership with St. Vincent de Paul.

We also offer a variety of assistance programs for those who are struggling with their bill. These resources include the Energy Sport programs, which provides limited income customers with up to a 60% discount on their monthly bill; Crisis Bill Assistance that provides up to $1,000 annually to qualified limited-income customers who experienced unexpected financial hardships; and Project SHARE, which is a Salvation Army-administered service, providing up to $500 annually in emergency bill assistance.

We plan years in advance to serve customers with reliable and affordable energy. Our resource planners secure a diverse energy mix to meet demand like things like solar and wind and rely on the energy provided by our share of the Palo Verde Nuclear Generating Station. When temperatures caused demand to increase, APS’s strength and resilience comes from using flexible resources like natural gas and energy storage to keep homes and businesses cool over long stretches of extreme heat.

We’ve taken all of the above approach to provide the most affordable and reliable service when our customers need us the most. And as part of our vigorous planning, we’ve recently executed agreements on multiple projects resulting from our 2023 All-Source RFP to be online between 2026 and 2028, and that includes over 400 megawatts of APS-owned resources, and those are already reflected in our capital plan.

We’re still in negotiations on additional projects, and we look forward to announcing those in the future, and we are always seeking the best combination of resources to serve our customers reliably, while not sacrificing affordability and continuing to build towards our clean energy future.

Additionally, we remain focused on providing exceptional customer service. I’m proud to share that through the first two quarters of the year, the 2024 J.D. Power Residential and Business Survey results have placed us in the first quartile compared to peers. We’ve made remarkable progress over the past few years moving from fourth quartile to first, and I can absolutely say that progress would not have happened without the dedication and commitment of our hardworking employees across the company.

Turning to regulatory update. The Commission has continued to progress in the regulatory lag docket at the July open meeting, the Commission unanimously voted to hold additional workshops and the next workshop is scheduled for October 3rd. Commission staff stated that the workshops will be focused on formula rates and future test years with experts sharing their experience with each of these regulatory structures and we’ll continue to work with the commission and stakeholders on this important issue of reducing regulatory lag in Arizona.

We’ve made solid progress through the first half of this year, improving our customer experience, enhancing our stakeholder relationships and executing on regulatory priorities. And we look forward to continuing to provide exceptional service for our customers through the balance of the year.

And with that, I’ll turn the call over to Andrew.

Andrew Cooper

Thank you, Jeff, and thanks again to everyone for joining us today. This morning, we released our second quarter 2024 financial results. I will review those results and provide some additional details on key drivers for the quarter. We earned $1.76 per share this quarter, an increase of $0.82 per share compared to second quarter last year. New customer rates, weather and continued robust sales growth were the main drivers for the quarter-over-quarter increase.

The 2019 rate case appeal outcome, income tax timing and O&M savings were other positive drivers for the quarter. Higher interest expense and depreciation and amortization expense were the primary negative drivers compared to last year. As Jeff mentioned, we experienced the hottest June on record, which contributed to a $0.29 benefit from weather versus this time last year. As a reminder, last year, we saw the mildest June since 2009.

Our sales growth continued to be strong during the second quarter, providing a $0.24 benefit with total weather-normalized sales increasing 5.5% compared to second quarter last year. C&I(Commercial and Industrial) continued its robust growth at 10% for the quarter. This is primarily due to the ramping of large manufacturing and data center customers in our service territory. Although we are not changing 2024 sales growth guidance at this time, our weather-normalized sales growth year-to-date has aligned more closely with our long-term sales growth guidance of 4% to 6% and of which 3% to 5% is expected to be attributable to our extra high load factor customers.

Turning to economic conditions in Arizona. We experienced 2.1% customer growth in the second quarter and the fundamental economic factors supporting customer growth remains strong. National inflation is declining with the Phoenix Metro area in particular, experiencing a year-over-year inflation rate of 2.7% and as of June data, below the national average of 3%. Additionally, Arizona’s unemployment rate hit an all-time record low of 3.3% in June, which is below the national unemployment rate of 4.1%. These positive economic indicators underscore the strong support for continued growth in our service territory.

Our O&M(Operation and Maintenance) initiatives have delivered benefits this quarter. We have been successful in our efforts to lower core O&M expense across multiple areas of our operations, including both nuclear and non-nuclear generation costs. We are making progress in our planned outages to keep our generation fleet resilient and reliable and our goal continues to be declining O&M per megawatt hour, while ensuring we meet the critical reliability demands of the summer season.

While interest expenses rose in this quarter compared to last year due to higher debt balances and increased interest rates, we are managing our financing costs proactively. Additionally, our depreciation and amortization expense has increased, reflecting our investment in planned IT projects and other grid investments. These strategic projects are expected to yield long-term benefits even as they create additional drag throughout the year.

We have continued the successful execution of our capital investment program and related financing strategies this quarter as well as managing our debt maturities. This quarter, APS(Arizona Public Service) issued a $450 million bonds in early May. And in early June, we successfully closed on both $525 million in convertible notes and $350 million in floating rate notes at Pinnacle Labs. We are committed to seeking the most advantageous opportunities to strategically finance our capital plan.

Finally, all other aspects of guidance remain unchanged including 2024 EPS. However, if the sales growth and weather trends we experienced during the second quarter continue, we expect to be towards the higher end of our EPS range. We are closely monitoring sales growth and weather for the remainder of the year. We have had a strong first half of the year and are excited to continue executing our strategy throughout the rest of 2024. We are focused on ensuring our customers have safe and reliable power to navigate the summer heat.

This concludes our prepared remarks. I will now turn the call back over to the operator for questions.

Question-and-Answer Session

Operator

Certainly. [Operator Instructions]. Your first question is coming from Shar Pourreza from Guggenheim Partners. Your line is live.

Shar Pourreza

Hey guys.

Jeffrey Guldner

Hey Shar.

Shar Pourreza

Hey guys. Hey, Jeff. So just on — obviously, that’s been thematic, the weather-normalized sales growth, 5.5%, it’s in line with your longer-term, 4% to 6%. Can you just maybe elaborate on how sticky this is for the C&I backdrop? And if it’s sticky, obviously, that sets you all well for ’24, but how do we think about ’25 as we bridge from ’24? And what does this all mean to sort of your longer-term capital program and earnings guidance? Thanks.

Andrew Cooper

Hey Shar, it’s Andrew. Yes. So as you mentioned, 5.5% sales growth for the quarter, largely driven by those large C&I customers continuing to ramp up. And so you saw that coming from both the manufacturing customers, TSMC’s ecosystem as well as from the data centers. And so we’re still guiding to a lower range this year as that ramp starts up in a longer-term range of 4% to 6%. And that — we have not provided guidance out past 2026, and don’t intend to do so today either.

But if you think about the long-term, there is a backlog of these customers that’s substantial and extends beyond 2026. You have the second and third phases of TSMC committed. We have over 4,000 megawatts of data center customers that are committed as well. And that doesn’t even include the backlog of more than 10,000 data center requests that we’ve gotten beyond that. And so the stickiness of the large C&I sales growth is a pretty critical trend, and we expect it to continue based on what we’re seeing in the service territory.

The only other thing I would just add about the sales growth from this quarter is we saw a nice contribution to that C&I sales growth from small business. So two-thirds to 75% of the large C&I, that 10% growth in the C&I segment was from the larger customers. But we did see small businesses continue to flourish as well. And I think that speaks to what Jeff and I spend a lot of time talking about, which is the amplification effect of having a strong economy here and a rebuild manufacturing base, and we’re starting to see some of the effects of that.

Shar Pourreza

Yes. I mean the tailwinds are obviously pretty evident. I guess, Andrew, what’s the podium for you to revisit this and update investors? Is it sort of with the year-end update? Or could we see something closer as we get to EEI?

Andrew Cooper

We do typically — when we’re not in a rate case year, provide updates at the third quarter around EEI as we suggest. That’s certainly from the perspective of rolling forward our guidance, providing the long-term outlook on the sales growth as well as the capital that goes with it. I know in your first question, you asked about capital as well. So that would be — the intent would be to look at the third quarter there, as well as ensuring that we’re continuing to see these ramp trends. As we’ve seen over the last few years with these large high load factor customers, the ramps can be a little bit variable. And so we want to ensure that the 10% growth that we saw in the first half of the year continues before we make any changes to sales guidance.

SharPourreza

Okay. Perfect. And then just lastly, the reg lag docket that’s kind of out there, I mean, obviously, another workshop. Maybe just provide just a little bit higher level thoughts on kind of where the timeline stands today? Any incremental details you can provide coming out of the recent meeting and just additional milestones? Because it seems like it’s gaining fairly good traction, but I just wanted to see if there’s anything incremental to add there? Thanks.

Jeffrey Guldner

Yes, Shar. I’ll start and then anybody else can chime in. I think — so you are seeing the — bringing in the experts having a real dialogue around what are the systemic things that are being done in other places or in other jurisdictions, how does that work, I mean to me, the thing that’s encouraging is, I think it really does show that there is a desire to understand what this means and particularly important in the context that we’re moving into that the amount of capital that’s going to have to go into serving the growth in Arizona and to really leverage.

Like one of the key strengths of Arizona has been the broad regulatory environment, which has attracted so many of these customers like Red Bull and TSMC and others into the state. That’s got to pair with our ability to serve them and to meet the growth that’s coming. And so it’s really, I think, understanding that broader context that’s been helpful for these workshops. So it’s good that we’re seeing another one coming up in October. I think there’ll be some continued exploration or dialogue around what the different areas are. We said in the script here that a lot of the focus is right now on both the forward test years, but also the formulaic approach to rates, which is similar to FERC.

And so it’s still early in the process. I think they are working to try to move this through and at least get some alignment or direction articulated here throughout the rest of the year. So I think good progress and something that we’re definitely engaged in, trying to make sure that we can provide the support they’re looking for as they sort through some of these policy options.

Shar Pourreza

Perfect. Appreciate it guys. Congrats on the execution. It’s pretty notable.

Jeffrey Guldner

Yes, thank you, Shar.

Operator

Thank you. Your next question is coming from Nick Campanella from Barclays. Your line is live.

Nicholas Campanella

Hey, thanks for the time. I wanted to just put a finer point — I’m sorry if I missed it, but just is October really the date that you’re looking towards for this to be taken up. I just know that there should be some open meetings between now and then, but is it October?

Jeffrey Guldner

Yes. It’s October.

Nicholas Campanella

Okay. And then I guess just with the strong start to ’24, what are some of the negatives that we might not be contemplating here that would keep you within the guidance range? I know you kind of said that you’re at the higher end? And then just knowing that the long-term CAGR is not linear, obviously, it’s going to be predicated on rate outcomes, is there any kind of pull-forward opportunity from O&M or otherwise to kind of help derisk your ’25 outlook within the range?

Andrew Cooper

Sure. Hey Nick, it’s Andrew. So in terms of things that we’re monitoring for the rest of the year, as I mentioned earlier, certainly on the sales side, I want to make sure that ramp rate continues with our customers. Residential sales continue to have some customer behavioral elements that we watch as well, the end of a very hot summer, and we saw some of those at the end of the summer last year. But overall, the sales growth trends have been a positive tailwind to date.

The spot that we certainly continue to watch, and it will lead into your second question there is just around O&M. We’ve been very judicious in the first half of the year to engage some of those O&M savings. If you recall, our guidance for the year for O&M contemplates basically a 2% reduction in core O&M in order to accommodate some of the large planned outages that we have this year, which basically lead to a 2% overall increase in O&M. And so the largest of the outages is still on to come with Four Corners in the second half of this year.

And certainly, so as we watch the O&M picture, we’ve seen a good story year-to-date. Those savings from exercising our lean muscle and all the operating efficiencies that we look for every year at the company, those have played out according to plan. But certainly, as we engage in that outage and all the planning and work that we’ve done to make sure that it keeps us within our O&M range. That’s certainly the area that we’ll look to.

There aren’t a lot of other things that rise to the top of the list in terms of potential headwinds other than the normal economic and sales — top line related ones. We’ve derisked our financing plans for the year by doing all the financing we did. So we’ve kind of got a good handle on what our rate picture is for the year and the D&A is what it is based on the assets going into service.

So just going to your second part on O&M because I think certainly, the outage picture is the one that we watch for the rest of the year. With that weather benefit, we certainly have activated the internal dialog around the potential to take a look at our multiyear O&M plan and where we can derisk it. And part of the reason for that is actually that the Four Corners outage continues in ’25. And so our ability to have some flexibility in when we initiate some of these O&M projects, whether they’re on the T&D side, on the technology side, there’s a number of things that we look at and how we could toggle and have some agility in terms of how we approach them. So the short answer is yes, we’ll look at O&M as we continue to look at the weather and see what’s the outage schedule, how that pans out as well.

Nicholas Campanella

That’s great. I appreciate that color. And one more, if I could, just with the reg lag docket kind of gaining traction, you also kind of have this ACC election in the background as well, and that all kind of culminates around this Fall time line. But how do you kind of see that changing the direction of the lag docket, if at all?

Jeffrey Guldner

Yes, I think, I mean the lag docket is moving forward on the schedule that they’ve got there. I mean right now, the election, it’s pretty early. We’re just out of the primaries here, most of the attention right now is at the top of the ticket races. And so you’re not — I don’t think there’s been a lot of dialog yet on commission election issues. We continue to engage with the candidates on both sides. So it was an uncontested primary on both.

And so we’ve been in contact with the candidates on both sides in the scenario where we want to continue the dialog because again it ties back to the growth that we’re seeing in the state and the need to support that growth and that’s been consistent. Governor Hobbs has continued to be very supportive of growth in the state and do things that is following up on what our Republican predecessor is driving.

Nicholas Campanella

All right. Thanks a lot.

Operator

Thank you. Your next question is coming from Michael Lonegan from Evercore ISI. Your line is live.

Michael Lonegan

Hi, thanks for taking my questions. On the financing plan, just wondering if you have any updated thoughts on the timing and type of equity or alternatives. I know you previously said you were leaning towards an ATM program that could match up well with capital deployment.

Andrew Cooper

Michael, it’s Andrew. Yes, so no updates at this point. If you recall, we did our — the big block equity that we really wanted to use to make sure that we have a robust balanced capital structure down at APS. And that’s under forward so we’ll draw that over time, we have 18 months to do so. We derisk our maturities of both APS and Pinnacle West during the second quarter with a number of debt instruments and that used up a little bit of the debt — parent debt amount that’s in our three-year financing plan. So that really leaves predominantly the incremental external financing that we need to do at the parent, the $400 million number that we have there in the plan.

And ultimately, at the base case, there still really remains common equity. Certainly, we’ll look at other instruments, and those alternatives are out there. And as you said it best, Michael, it’s an ATM program is an ability to match up the capital needs with the external financing. And so that would be our base case. As we move through the year and think about when we roll forward our financing plan, an ATM tends to be a three-year program. And so we’re kind of done with our ’24 equity needs. And so as we look to ’25 through ’27, we’ll provide any updates, but the $400 million is the number that we’re targeting at the moment and ATMs certainly remains the base case.

Michael Lonegan

Great. Thank you. And then going back to the regulatory lag docket, depending on when it’s complete and what comes out of it, do you think you’ll start preparing a rate case filing right away and file that when that’s complete, that it’s done in, say, four to five months later? Or could we even see a rate case before that docket is finalized and in maybe various forms of what the regulatory lag docket could look like?

Jeffrey Guldner

Yes. I think right now, we’re just still working through the docket and trying to understand directionally where that’s going and that will help inform our path from that point. So let’s see what the next workshop looks like, so if they continue to work through the process. And obviously, we’ll keep people posted.

Michael Lonegan

Great. Thanks for taking my questions.

Jeffrey Guldner

Yes, thanks, Michael.

Operator

Thank you. Your next question is coming from Travis Miller from Morningstar. Your line is live.

Travis Miller

Good morning. Thank you.

Jeffrey Guldner

Hey, Travis.

Travis Miller

You talked a lot at the beginning about the customer bill assistance and the higher bills and stuff. Is there any chance with the weather if it either stays hot or get hotter that could impact working capital for you? Or the regulatory mechanisms that would offset some of that cash flow issue potentially?

Andrew Cooper

Yes. Certainly, we’ve been working over the last number of years where there’s a moratorium on disconnects and things during the summer. So our pace of customer receipts throughout the year tends to be fairly predictable. And so we plan our financing both the long-term and the availability of short-term capital to accommodate the normal pace of customer payments over the course of the year. And certainly, the programs that we participate in and direct funds directly from our bottom line too as well as the ones that we work with our partners all provide an opportunity to kind of reduce some of the pressures on customers from a build perspective over the course of the year, particularly as we come out of our summer season and those bills begin to be more front of mind for customers.

Travis Miller

Okay. Got it. And then another heat question, if we do see these unusual temperatures. What type of planning in terms of system resiliency or even equipment-type planning do you do for the heat? I’m thinking extreme weather taking out some of the equipment as we’ve seen with extreme cold weather in other places. What type of contingencies do you have on your system like that, if that makes sense?

Jeffrey Guldner

Yes, I’ll start. I mean that’s part of the process, and we’ve obviously been through — if you go back and look historically, the hottest temperature we’ve had in Phoenix was actually — was it 2018 or so, it was a while ago. And so you always have to manage through with this. And there’s a lot of focus around personnel. So how do you make sure that your crews who are working out in the heat have access to air-conditioned trucks and that we manage the workflow there. And then a fair amount of work just on the equipment every year, making sure that we look for resiliency that we monitor the equipment, that it does have some heat sensitivity. Ted and Jake, anything?

Ted Geisler

Yes. I think, Jeff, you said it well. The only thing I’d add as well is the temperature we’ve seen so far as well within our design criteria and what we plan for, it is interesting that while we saw sales higher in Q2 in large part due to weather, we still didn’t break our peak demand compared to last year. And so that’s really an indication that we saw higher low temperatures at night, and we had more consistent days around 110 degrees or above. But we actually didn’t see the top end extreme heat as much as we did the year prior.

So from an equipment standpoint, we take it seriously. We have resiliency plans. We study each summer, and that informs our future design criteria. But we’re actually sitting pretty good in terms of having the impact on equipment, follow exactly where we would expect it to be, and we’ll continue to monitor and adapt along the way.

Jeffrey Guldner

Yes. Just a correction, the highest temp in Phoenix recorded was in 1990, 122 degrees. And so this is just something in a desert environment you plan for hot summers.

Travis Miller

Whenever you want to send that heat to Chicago, I’d appreciate it. I’ll even trade you some 0 degrees over there, if you’d like. And I appreciate the thoughts.

Jeffrey Guldner

Yes, thanks Travis.

Operator

Thank you. Your next question is coming from Julien Dumoulin-Smith from Jefferies. Your line is live.

Julien Dumoulin-Smith

Hey guys, can you hear me?

Jeffrey Guldner

Yes, hey Julien. We can.

Julien Dumoulin-Smith

Hey guys. It’s pleasure. Thanks for the time. Appreciate the opportunity. So maybe just coming back to the rate case timing and just the expectations of how this would filter in on the reg lag front. Obviously, making good progress here on that front. It sounds like it wouldn’t be too long, a short period of time, subsequent to its resolution, say, in October, so early ’25. Is your expectation here that ultimately, the impacts would be, call it, mid ’26-ish, if you wanted to put a till date to it in terms of addressing that lag and having a partial year? And then maybe you could be a little bit more specific on how you think the extent of that is going right now on resolving some of that lag? Just if I can press you a little bit further.

Jeffrey Guldner

Yes. Julien, on the process, I mean, so there’s a workshop schedule next in October. That’s kind of the data point that is out there. So more dialog. And I think I would expect the commission might give a little more guidance or at least have some dialog on how they see that process moving forward. Once you see visibility into that, I think it’s pretty standard. Everybody has about the same schedule. It takes about six months to put together filing, and then it typically takes about a year to work through it. You’ve got factors like settlement, possibilities and other things that come into the analysis.

And so we’re in August right now, workshop coming in October. We’ll see how the dialog continues to go and then look at how that would affect the schedule and the timing. One of the things that you’re starting to see, and this goes back to a program that we had in place, and you probably remember it, the Arizona Sun program from a number of years ago. I think we got that approved in 2012 is time frame, and that allowed us to move forward with a tracking mechanism to get more concurrent recovery of capital that we are investing in that case with solar plants. And now that’s part of the SRB process.

And so there already is some movement that is helping us to address some of those regulatory lag items. The SRB is the one that was activated in the last case and it applied to not just us, but another utility here in the state. And so those are the kind of things that you just have to continue to work through as the Commission addresses the issues so that we can get back to where there’s more contemporary recovery of the capital that we’re investing to serve the growth we have.

Julien Dumoulin-Smith

Awesome. And then related to that, if I can push you the SRB you just alluded to. I mean, in theory, there’s no — it’s an evergreen program, right? As in to the extent we get subsequent revisions on your generation needs, to the extent to which that you’re still in negotiation on some of the assets here as long as it goes through your typical procurement processes, all of that would still be eligible to participate in the SRB, right?

Jeffrey Guldner

Yes.

Julien Dumoulin-Smith

Okay, excellent. Thank you very much.

Jeffrey Guldner

Yes, you bet.

Operator

Thank you. [Operator Instructions] Your next question is coming from Paul Patterson from Glenrock Associates. Your line is live.

Paul Patterson

Hey, good morning guys.

Jeffrey Guldner

Hey, Paul. Good morning.

Paul Patterson

Just — and I apologize for being slightly unclear. But it sounds to me from just listening to the call that perhaps you guys are expecting this regulatory lag proceeding to move somewhat rapidly from a regulatory time. And I just want to make sure I understand this. So there’s a workshop, as you mentioned, scheduled in October, but you think that things might move rapidly after that? I just wanted to get some sort of sense on that. And would it be safe to assume that you guys are not going to be filing a rate case until you get a determination in that proceeding?

Jeffrey Guldner

On the latter, we don’t know where the proceeding is ultimately going to go. I wouldn’t say that. I think, again, we’re in August, there’s a workshop scheduled for October. I would expect that, that workshop that the Commission would have some dialog on kind of where they feel they are in the process and what they think the timing is going forward.

I think to your point, I think they are being pretty deliberate in how they’re moving the workshop process forward. But it’s kind of hard to sit here and give you expected dates and everything. I think we’ll see how the dialog goes in October, see how comfortable they get with the information that they’re hearing and get a check in at that point on what we expect to see from a process standpoint moving forward.

Paul Patterson

Okay, thanks for the clarification. I appreciate it. Have a great one. Stay cool.

Jeffrey Guldner

Yes, thanks Paul.

Operator

Thank you. That completes our Q&A session. Everyone, this concludes today’s event. You may disconnect at this time, and have a wonderful day. Thank you for your participation.

컨퍼런스 콜 요약

컨퍼런스 콜 전문을 읽고 다음과 같이 요약할 수 있었다.

- 2분기엔 최근 10년 평균보다 24% 더 높은 기온으로 평년보다 실적이 좋았다.

- C&I(Commercial and Industrial)의 실적이 10% 상승했는데, 데이터센터와 대형 제조사(TSMC)의 램프업 덕분이었다.

- 2분기에는 고객 수(residents and businesses)가 2.1% 증가했다.

- TSMC와 4,000MWh에 해당하는 데이터센터 수요로 성장세는 2026년 이후까지 이어질 것. 매출의 롱텀 가이던스는 4-6% 성장 수준.

- Data center 수요 4,000MWh는 아직 10,000 건에 달하는 데이터 센터 건설 요청을 포함하지 않은 수치.

- Small business로부터의 수요도 꽤 높았음.

- Guidance를 올리기 위해서는 C&I의 10% 성장이 앞으로도 이어지는지 봐야할 것.

- Arizona의 장점 중 하나는 규제 환경이다. 덕분에 레드불이나 TSMC가 애리조나로 온 것. 또한 규제 환경에 더불어 적절한 에너지를 공급할 수 있는 능력(APS) 또한 중요하다.

- 현재로써 우려되는 역풍은 매크로 이슈 외엔 없음.

- 10월 워크샵에서 위원회(ACC)와의 미팅이 있을 예정인데, 거기서 무슨 이야기가 나올 지는 아직 전혀 알 수 없다.

애리조나에서 데이터센터의 건설이 늘어나고, TSMC 공장이 램프업하면서 인구도 늘어날 예정이다. 인구가 늘면 비즈니스도 늘어나는데 그 덕에 C&I의 성장이 10%를 기록했다. 올해에도 계속해서 이정도 수준의 성장을 보이면 PNW 경영진은 2025년 가이던스를 (롱텀 매출 성장 가이던스보다 더 높이) 상향할 예정이다. 애리조나는 ACC의 규제가 유독 심했던 것으로 유명했는데, 2021년 이후 분위기가 좋아지고 있는 상황. 하지만 여전히 다른 주에 비해 규제가 심한 편으로 regulatory lag이 긴 편이다. 즉, ROE를 올리기가 어렵고, 시간도 오래 걸린다.

잠정적인 결론

아직은 생소한 산업이기 때문에 조금 더 공부해야 한다. 모르는 부분도 많고, 불확실한 부분도 많다. 단, 전력 수요가 증가하고, 규제가 완화된다면 데이터센터의 수혜를 ‘안정적으로’ 볼 수 있는 기업인 것 같다. ACC 선거 결과와 10월 회의에서 어떤 이야기가 오가는지, 뉴스를 모니터링 해봐야 할 것 같다.

당장 최근에는 원전 관련주가 많이 올랐지만, 결국 데이터 센터 발 훈풍은 전력을 최종적으로 공급하는 PNW와 같은 기업에게도 좋은 영향을 주지 않을까 생각한다.

나만의 생각은 아닌 것이, 실제 주식 시장도 그렇게 반응하고 있다. 최근 6개월 간 가장 강력한 흐름을 보이는 섹터 답게, PNW의 주식은 6개월 간 꾸준히 올랐다. 지난 보험사 투자의 기회를 놓친 것을 기억하자. 당시, WSJ에 보험료 증가가 보도된 이후에도 다수의 보험사들의 주가가 6개월 간 두 배 이상 올랐다. 보험사도 똑같이 보험료를 올리는 부분에 대해 규제를 받는다. 유틸리티 기업만큼 강력한 규제는 아닌 것 같지만.

지금의 PNW를 포함한 다른 유틸리티 기업의 주가가 신고가를 기록하고 있는데, 너무 올랐다고 생각할 건 아닌 것이 그래봤자 저점 대비 30% 정도 올랐을 뿐이다. 게다가 오름세가 심상치 않다. 거의 4년 중 신고가를 기록하고 있으며 더욱 중요한 건 천천히 상승하고 있다. 천천히 상승한다는 건, 매수자들이 이성을 잃고 한꺼번에 달려들었다는 게 아닌, 차분하게 꾸준히 매수하고 있다는 신호다.

유틸리티 기업으로써 이익을 늘리는데엔 한계가 있겠지만, 규제는 ROE에 초점이 맞춰져 있고, 대량 투자를 통해 분모를 늘리면 분자인 이익도 크게 늘릴 수 있을 것이다. 한참 부족한 전력을 충당하기 위해선 대규모의 투자가 반드시 필요하고, 이익은 필연적으로 상승할 것이다. 규제가 완화된다거나 regulatory lag이 줄어든다면(아마도 그럴 것 같지만) PNW의 가치는 더 올라갈 가능성이 높다고 생각한다.

※주의사항※

이 블로그는 전문 투자자가 아닌 개인이 운영하는 블로그입니다. 미국, 국내, 다양한 기업에 대한 투자 정보를 포함하고 있습니다.

블로그 포스팅에는 실제와 다른, 부정확한 정보가 포함되어 있을 수 있으며 블로그 운영자인 저는 작성된 포스팅 내용의 정확성을 보장하지 않습니다. 이 블로그의 정보를 기초로 실행된 투자에 대해 이 블로그 및 저는 어떠한 책임도 지지 않습니다. 포스팅 정보를 기초로 실행된 모든 투자의 책임은 투자자 본인에게 있습니다. 이 블로그는 저 스스로의 공부를 위한 공간이며 방문자님들의 공부를 위한 공간이기도 합니다. 단순한 지식 확장을 위한 공부 이외의 용도로 이 블로그를 이용하는 경우 저는 어떠한 책임도 지지 않습니다.

블로그 포스팅은 모두 10-K, 10-Q, 8-K 등 SEC에 공시된 공개된 문서를 기초로 하며 해당 정보를 제가 가공하여 작성됩니다. 모든 포스팅의 저작권은 이 블로그 운영자인 제 자신에게 있습니다. 포스팅 내용을 지인과 공유하는 것은 정말 감사한 일입니다만 포스팅 내용을 그대로 또는 조금 변형하여 자신의 블로그에 올리는 행위, 개인적인 목적 이외에 사용하는 행위는 저작권법에 의해 처벌될 수 있습니다.

언제나 이 블로그를 방문해주시는 방문자분들께 진심으로 감사드립니다.